Oct 2025 Jobs Report

The labor market softened in September and inched up in October—but the more important story is accelerating AI-linked restructuring.

Economic Crisis and the AI Disruption: A Comprehensive Analysis

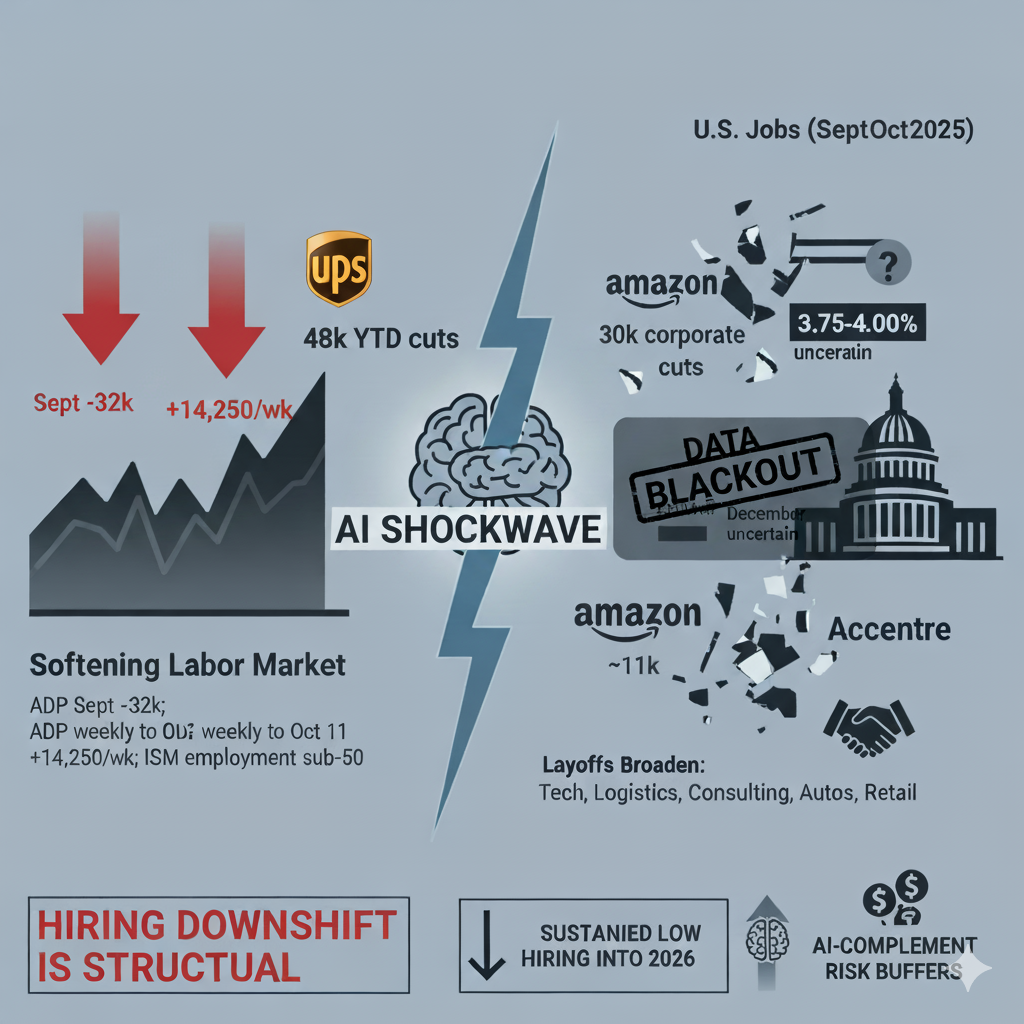

U.S. Jobs (Sept–Oct 2025) + AI Shockwave

Bottom line: The labor market softened in September and inched up in October—but the more important story is accelerating AI-linked restructuring. Layoffs are broadening from tech into logistics, consulting, autos, and retail. With a data blackout from the federal shutdown and a split Fed, these weak prints look less like noise and more like the opening phase of a multi-year labor reallocation.

Trivium TL;DR

Grammar (facts): ADP Sept −32k; ADP weekly to Oct 11 +14,250/wk; ISM employment sub-50; UPS 48k YTD cuts; Amazon up to 30k corporate cuts; Accenture ~11k; Fed cut to 3.75–4.00% with December uncertain; shutdown blacks out BLS; Trump–Xi tariff trim.

Logic (inference): Converging weak private gauges + broadening AI layoffs ⇒ hiring downshift is structural, not just cyclical.

Rhetoric (so what): Plan for sustained low hiring into 2026; prioritize AI-complement upskilling and risk buffers (for households, firms, and funds).

Federal Reserve Policy and Economic Uncertainty

Interest Rate Decisions

Federal Reserve Chairman Jerome Powell lowered interest rates for the second consecutive meeting, though the reduction was modest. When asked about market expectations for another rate cut at the December meeting, Powell responded with the phrase "far from it," which immediately sent markets into turmoil and erased some of the day's gains.

Key Economic Challenges

Powell's comments reveal that the easiest phase of unwinding the central bank's aggressive rate increases may be over. He is navigating a Federal Reserve committee with a growing chorus of officials questioning whether rate cuts are even warranted at this point.

Data Blackout Crisis

A critical factor complicating economic policy is the ongoing government shutdown, which has lasted 25-26 days. This has resulted in a complete data blackout from the Bureau of Labor Statistics (BLS) and other federal agencies that typically provide essential economic data. The Federal Reserve is essentially "flying blind" without this information, making informed policy decisions nearly impossible.

Tariff Policy Volatility

Adding to the uncertainty, tariff policy remains unpredictable. President Trump and President Xi recently met in South Korea for an hour and a half, announcing a reduction in the overall number of China tariffs. However, markets have largely priced this in, as it was effectively telegraphed beforehand. The combination of precarity, lack of data, and inconsistent policy creates an extremely challenging economic environment.

Mass Layoffs Across Industries

Scale of Job Losses

Major corporations are announcing massive workforce reductions:

- UPS: 48,000 employees (management and operations roles)

- Amazon: Up to 30,000 employees

- Intel: 24,000 employees

- Nestle: 16,000 employees

- Accenture: 11,000 employees

- Ford: 11,000 employees

- Novo Nordisk: 9,000 employees

- Microsoft: 7,000 employees

- PWC: 5,600 employees

- Salesforce: 4,000 employees

- Paramount: 2,000 employees

- Target: 1,800 jobs (specifically white-collar positions)

- Kroger: 10,000 employees

- Applied Materials: 1,444 employees

- Meta: 600 employees

General Motors Electric Vehicle Layoffs

GM is laying off 3,300 workers associated with electric vehicle production. This reflects the whiplash in policy direction between administrations - the Biden administration provided incentives for both consumers and automakers to move toward EVs, while the Trump administration reversed course 180 degrees in the opposite direction.

Timing and Context

These layoffs are occurring just ahead of the holiday season, representing what appears to be a very troubling trend. The UPS layoffs are particularly striking because they're happening during what should be the busiest season for package delivery, signaling that the company believes it can function without these workers even during peak demand.

The AI Revolution and White-Collar Job Displacement

Artificial Intelligence as Primary Driver

According to Wall Street Journal reporting, tens of thousands of white-collar jobs are disappearing as AI "starts to bite." The embrace of artificial intelligence is the primary factor behind these workforce reductions, with executives hoping AI can handle work previously done by well-compensated white-collar employees.

Types of Jobs Being Eliminated

Companies are targeting what they consider "grunt work" and administrative costs in departments like HR and legal. Entry-level positions are particularly vulnerable, as this is exactly the sort of work that companies believe can be delegated to AI systems.

Corporate Motivations

Multiple factors are driving these decisions:

- Wall Street Rewards: Stock prices surge when companies demonstrate they can eliminate human workers. Investors have been pushing executives to operate more efficiently with fewer employees.

- Anticipated AI Capabilities: Even companies that haven't fully figured out how to incorporate AI effectively are preemptively laying off workers because they anticipate being able to use AI in the future. They want the immediate Wall Street rewards from announcing workforce reductions.

- Economic Uncertainty: The erratic nature of current policy creates massive uncertainty for business owners, making them reluctant to make large-scale investments or build out their workforces.

Workplace Transformation

The remaining workforce faces significant challenges. Managers now supervise more workers with less time to meet with them individually. Employees who keep their jobs are saddled with much heavier workloads, working more hours for the same pay while someone else (primarily investors) captures the increased profits. Companies claim increased productivity and decreased costs from AI but are not lowering prices for consumers.

The College Graduate Employment Crisis

Deteriorating Job Market

The college class of 2025 submitted significantly more job applications than the class of 2024 while receiving a smaller number of offers, according to the National Association of Colleges and Employers. The unemployment rate for new college graduates continues to tick upward. Graduates are filing thousands of applications with minimal or no job offers in return.

Long-Term Career Disruption

The analysis highlights that this isn't just affecting entry-level workers. Recruiting firms report a surge in 40-year-old workers who have been laid off and cannot keep up with technology that is outpacing their skill set. These individuals have approximately 25-27 years until retirement - nearly 30 prime working years ahead of them - making their displacement particularly devastating.

Personal Stories of Economic Devastation

The 33-Year-Old Technologist

One particularly tragic case involves a 33-year-old father of three with technology experience who spent 10 months looking for work. During this period:

- He applied to over 1,000 jobs

- To cover basic necessities (food, gas, utilities), he emptied his 401(k), sold stocks, cryptocurrency, and even the Pokemon cards he collected with his son

- His home went into foreclosure when he couldn't make mortgage payments

- He eventually found work at a car dealership through a friend's referral

- He now commutes 2+ hours each way

- He works from 8:30 AM to 9:00 PM on the sales floor

- He's considering driving in on his day off just to make ends meet

- He describes having no work-life balance despite having three children

This occurred in New Braunfels, Texas, not a high cost-of-living area where houses should cost only a couple hundred thousand dollars for a reasonable family home. The fact that someone with skills and experience ended up effectively bankrupt and working in car dealership sales (with no disrespect to that profession) illustrates the severity of the crisis.

Historical Parallel: The GM Plant Closures

This situation echoes the 2008 GM plant closures documented in film. Workers were told they had jobs, but not in their community - they had to relocate, often living in temporary housing together while trying to maintain family connections. These were generational residents whose families and entire towns were decimated within a decade. The suggestion is made that it would be worthwhile to revisit these areas nearly two decades later to document the complete "soul-sucking" devastation that likely occurred.

Structural Economic Analysis

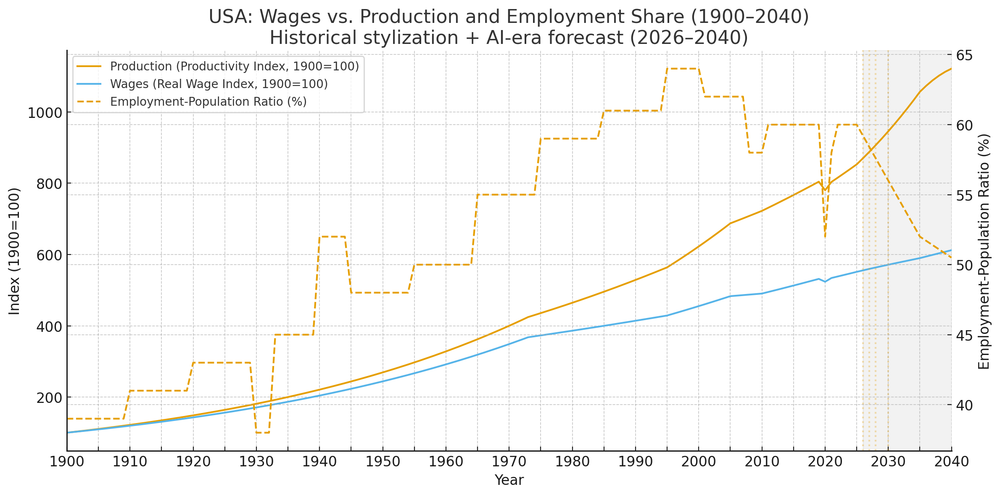

The AI Bet and Systemic Risk

The United States has placed an "entire bet" on AI across multiple dimensions:

- Stock Market Concentration: Markets are heavily concentrated in AI-related companies

- Infrastructure Investment: Massive resources flowing into data centers

- Labor Force Restructuring: Workforce being reorganized around AI capabilities

The assessment is stark: if AI fails to deliver on its promises, the result could be worse than the 2008 Great Recession. The economy is structured such that success depends entirely on AI validation.

The "Just the Beginning" Argument

A critical observation is that current AI technology "still really kind of sucks" - it has significant limitations and hasn't achieved the transformative capabilities promised. Yet even at this early, relatively ineffective stage, there are already:

- Massive layoffs across industries

- Skyrocketing joblessness for college graduates

- 40-year-olds unable to restart careers

- Complete elimination of career change possibilities

- People unable to survive despite doing "everything right"

If this is the impact when AI is relatively primitive, the implications of more advanced AI are potentially catastrophic for the labor force.

The Best-Case Scenario

The most optimistic projection offered is that AI never progresses beyond its current limited state - that it continues to "kind of suck" and can't really accomplish all that much. In this scenario, there would be "some labor force disruption, but it's not cataclysmic." However, the trajectory companies are pursuing suggests they are attempting nothing less than a "revolution from the top."

Political and Democratic Implications

Lack of Political Response

Despite the magnitude of the UPS layoffs alone - 48,000 middle-class workers in management and operations - there has been virtually no response from major national politicians. These workers, who likely "did everything right," lost their jobs ahead of the holidays without significant political attention or intervention.

Republican Party Economic Standing

For the first time in quite a while, Democrats have taken the lead in polling on which party is better positioned to keep the country prosperous. However, the Democratic advantage is modest (plus-4), suggesting neither party inspires significant confidence in their ability to guide the economy through this uncertain era.

The Republican advantage on economic issues that existed in 2023 was likely due to Democrats being in power at that time. Now that Republicans control government, their economic approval is declining, suggesting a pattern of the party out of power receiving better economic ratings regardless of actual policy competence.

The "Autopilot" Problem

The analysis suggests that no political party has a real vision or attention to the actual mechanisms that make society function. Economic policy appears to be on "autopilot," completely in the hands of corporate leaders rather than democratic institutions.

Sam Altman and Undemocratic Power

OpenAI CEO Sam Altman is cited as having sole authority to make critical decisions that affect society:

- Whether to introduce mass AI-generated pornography into public spaces

- How to handle mental health crises and suicidal ideation in AI interactions

- The pace and nature of AI deployment across industries

These decisions are made without democratic input or oversight, described as both "amoral and undemocratic." The fundamental issue is that citizens never got to "weigh in on any of this" despite its massive implications for society.

Historical Context: Post-1900 Era Democratic Control

The relationship between labor and capital since the Gilded Age was based on a democratic decision that large companies should not control every facet of life. Society collectively decided to "take back democratic control" through government regulation and oversight. The current situation represents a complete abandonment of this principle, with corporations allowed to "do whatever they want," putting everyone at tremendous risk.

The "Real Great Replacement Theory"

Politicians Funneling Resources to Oligarchs

The argument is made that current politicians are actively "funneling money and favors to a few giant corporations and a few oligarchs who want to make your labor irrelevant." This is characterized not as a hidden conspiracy but as an openly acknowledged reality.

Connecting Infrastructure to Job Losses

It's only a matter of time, the analysis suggests, before people connect:

- Rising electricity bills

- Data centers being constructed across the country

- Increasing white-collar layoffs

- Amazon's stated goal to replace 600,000 blue-collar warehouse workers

Blue-Collar Warehouse Work at Risk

Amazon warehouse jobs represent one of the few remaining opportunities for high school graduates - physical, difficult work, but paying $20-25 per hour and available without advanced degrees. The push to automate these positions out of existence eliminates even this pathway for workers without college education.

Radicalization Prediction

A powerful observation is made about future political radicalization: "You will never meet a more radicalized person than the person who like did all the things, went to business school, took all on all this debt or went to law school, took on all this debt and then there is nothing for them."

This describes people who followed the prescribed path for economic success - higher education, professional degrees, significant debt investment - only to find no employment opportunities waiting for them. This is described as "the reality now and the accelerating future."

Media Coverage and Public Awareness

Lack of Coverage

Despite the magnitude of these layoffs and their implications, mainstream media coverage has been minimal. The question is raised: "Did you really hear about it anywhere?" The UPS story with 48,000 job losses, covered as a lead story on Breaking Points, received little attention from other major outlets.

Tucker Carlson's Venezuela Analogy

Recent commentary from Tucker Carlson is cited, where he specifically stated he doesn't care about Venezuela right now, even as Senator Lindsey Graham discussed Venezuela supporting Hezbollah as justification for intervention. The point is that AI-driven job displacement represents an actual "imminent threat to the very foundations of who we are," unlike distant foreign policy concerns, yet receives far less attention.

Priority Misalignment

Political discourse focuses on foreign policy issues and culture war topics while ignoring the fundamental economic transformation happening domestically. This represents a complete misalignment between what politicians discuss and what materially affects citizens' lives.

Economic Sectors Analysis

Cross-Industry Impact

The job losses span multiple sectors, demonstrating this is not a sector-specific phenomenon but a broad economic transformation:

- Technology: Intel, Microsoft, Meta, Amazon

- Logistics: UPS, Amazon

- Retail: Target, Kroger

- Manufacturing: Ford, GM, Applied Materials

- Pharmaceuticals: Novo Nordisk

- Food/Beverage: Nestle

- Professional Services: Accenture, PWC

- Software: Salesforce

- Media: Paramount

The "Learn to Code" Irony

A particularly bitter irony is noted: for years, displaced workers and young people were told to "learn to code" as that was the "job of the future." Now, coding and technology jobs are among the first being eliminated by AI, contradicting the guidance that shaped career decisions for millions of people.

Promotional Content: Breaking Points Merchandise

Holiday Merchandise Announcement

Breaking Points announced 20% off holiday merchandise for premium members, including:

- Christmas sweater (which sold out the previous year)

- Breaking Points socks (described as high-quality, made in America, union-made)

The hosts emphasize they're "not making a ton of money off these things" and it's "purely for fun." They highlight the commitment to American manufacturing and union production, noting this makes the products not cheap but ensures quality and supports domestic labor. Premium members receive a discount code via email.

The socks receive particular endorsement as genuinely high-quality products that one host wears regularly for travel, having received organic compliments from people unaware of their origin, including a shoe salesman.

Systemic Questions and Future Outlook

The Fundamental Question: "What Are We Going to Do?"

A central theme throughout the discussion is the question: "What are we going to do about this?" This is posed not rhetorically but as a genuine crisis requiring immediate attention.

The observation is made that society is watching AI's intended purpose become clear - "to replace every single one of you" - and there is no coherent response or plan from political leadership, corporations, or other institutions.

Inevitable Popular Reaction

While there's no current organized response, the analysis predicts there will inevitably be a reaction from people "looking at this landscape for themselves and their kids" who "literally don't know what to do to survive now because there's no entry level positions."

Certain job categories are being "eliminated completely," and workers face an environment where standard career advice has become obsolete. The traditional pathways to middle-class stability - getting a degree, gaining experience, working hard - no longer guarantee employment or economic security.

The Existential Nature of the Crisis

The discussion characterizes this moment as potentially more significant than typical economic downturns. This represents a fundamental transformation in the relationship between labor, capital, and technology that could permanently alter the social contract that has defined post-industrial societies.

The comparison to the Gilded Age suggests we may be entering a new era where corporate power operates without democratic constraint, with potentially devastating consequences for social stability and individual economic security.

The last "Gilded Age" was 1920's and that did not work out so well..

Retirement and Investment Risk

Nvidia Connection

Nvidia in relation to retirement security, suggesting the company represents concentrated risk in retirement portfolios due to its centrality in the AI investment thesis. If AI fails to deliver on promises, retirement accounts heavily weighted toward AI-related stocks could suffer catastrophic losses.

Concentration Risk

Concerns about portfolio concentration. If the economy has placed an "entire bet" on AI, and individual retirement accounts mirror this concentration, the failure of AI to deliver expected returns could wipe out retirement savings for millions of people who have no control over these investment decisions.

Summary Assessment

Critique of current economic conditions, centered on the thesis that artificial intelligence is driving a fundamental and potentially catastrophic transformation of the labor market. The analysis connects:

- Immediate job losses across industries and skill levels

- Structural changes in corporate employment practices

- Political dysfunction and lack of democratic oversight

- Systemic risks to economic stability and retirement security

- The human cost measured in individual stories of economic devastation

- The absence of meaningful political response or policy solutions

The overarching argument is that society stands at a critical juncture where technological change, corporate power, and political abdication are combining to eliminate the possibility of economic security for vast numbers of people who followed traditional paths to middle-class stability. The discussion characterizes this as a "revolution from the top" proceeding without democratic consent and with potentially devastating consequences that are only beginning to materialize.

Data Used to help quantify the reporting

Gemini

Best guess for September 2025

Based on private data, the best guess for September is a labor market slowdown, potentially tipping into job losses.

- ADP Report: Private payroll processor ADP reported that U.S. private-sector employment dropped by 32,000 jobs in September.

- Carlyle Group Estimate: Data from this investment firm, based on its portfolio companies, indicated 17,000 jobs were added in September—a significant slowdown from August's 22,000 jobs.

- Services Sector Contraction: The Institute for Supply Management's survey of supply-chain executives showed that services employment contracted in September for the fourth consecutive month.

- Expert Consensus: A survey of economists by the Wall Street Journal earlier in October showed that forecasters were expecting only 15,000 jobs per month in the final quarter of 2025, reflecting a significant drop in hiring.

Best guess for October 2025

Private payroll data indicates a very modest improvement for early October, but the overall picture remains weak.

- ADP Weekly Estimates: ADP began releasing weekly job-gain estimates for October. Their data showed an average weekly increase of 14,250 jobs for the four-week period ending October 11. This suggests monthly job growth of approximately 55,000, a modest rebound from September's reported job losses.

- Differing Indicators: According to a New York Times report, the lack of official government data has led to conflicting signals from various private sources, making it difficult to get a clear picture of the economy's direction.

- Seasonal Hiring: Reports from Indeed's Hiring Lab showed a surge in job seeker interest for seasonal holiday jobs in October. However, the number of seasonal job postings only saw a modest year-over-year increase, and fewer companies were "urgently hiring" compared to previous years.

chatGPT - custom

Here’s my best-guess read on the U.S. jobs picture using high-frequency and private indicators (ADP, ISM, Challenger, Indeed, Carlyle, etc.). I cite each load-bearing fact so you can spot the signal in the noise.

Summary: Signals point to a September dip (very soft to slightly negative) and a muted October rebound (positive but small). The services-employment gauges stayed in contraction; layoffs remained elevated but eased from August; seasonal hiring interest rose faster than postings.

Best guess for September 2025

Call: Flat to slightly negative total employment (roughly −25k to +20k), central estimate around −10k.

Why: Private-sector trackers weakened simultaneously: ADP printed a decline; ISM services employment stayed below 50; layoff announcements were high YTD even as September cuts eased from August; Carlyle’s “shadow” payrolls were barely positive.

- ADP Report. ADP’s National Employment Report showed private payrolls −32,000 in September (after rebenchmarking).

- Services-sector employment contraction. ISM Services Employment Index 47.2 in September (fourth straight sub-50 reading), consistent with ongoing shedding of service jobs.

- Manufacturing jobs signal. ISM Manufacturing Employment 45.3, still in contraction (8th consecutive month).

- Layoffs backdrop. Challenger reported 54,064 announced cuts in September (−37% vs. Aug.), but year-to-date cuts remained historically high. This argues for caution despite the month-over-month improvement.

- Carlyle Group estimate. Carlyle’s proprietary portfolio-based read put September at +17,000 jobs, i.e., very weak but not outright negative.

Synthesis for September: With ADP (−32k) on one side and Carlyle (+17k) on the other—plus ISM employment sub-50—the preponderance points to near-zero growth with a downside tilt. Hence the −10k central “best guess.”

Best guess for October 2025

Call: Small positive gain (roughly +35k to +75k), central estimate around +55k.

Why: New weekly ADP estimates turned slightly positive; seasonal hiring interest rose, but postings only inched up; services employment remained soft and layoffs stayed elevated on a YTD basis.

- ADP Weekly Estimates. ADP launched weekly private-employment estimates; the four weeks ending Oct. 11 averaged +14,250/week → implied ~+55k monthly pace.

- Differing indicators / data blackout context. Because a federal shutdown reduced official data flow, economists leaned on private sources—useful but methodologically different and sometimes conflicting. (This is why I give a range.)

- Seasonal hiring dynamics. Indeed Hiring Lab: job-seeker interest in seasonal work was up 27% YoY (and ~50% vs. 2023), yet seasonal postings were only +2.7% YoY and fewer ads were marked “urgently hiring” (2.1%, vs. ~10% at late-2021’s peak). Net: demand > postings, so seasonal lift is modest.

- Layoff climate. Media tallies using Challenger data noted nearly 950k cuts YTD through September—the highest since 2020—keeping a headwind under the surface even if October hiring inches up.

Synthesis for October: Early-month ADP weekly points to a tepid rebound from September’s weakness; seasonal hiring helps at the margin, but subdued postings and persistent layoff pressure cap the upside. Hence the +55k central “best guess.”

What could move these guesses off-target?

- Method divergences. ADP, Carlyle, UKG, Homebase, Revelio, etc. all sample different universes; they often diverge from BLS in both sign and magnitude. (September already shows a −32k vs. +17k split.)

- Services sensitivity. With services employment below 50 on ISM, a small swing in hiring freezes/attrition can push the total above/below zero.

- Seasonal effects. Holiday timing quirks (retail/logistics onboarding, weather) can distort October readings relative to trend.

TL;DR (one line each)

- September 2025: ~−10k (range −25k to +20k): ADP negative, ISM employment sub-50, layoffs high; Carlyle slightly positive.

- October 2025: ~+55k (range +35k to +75k): ADP weekly signals weak growth; seasonal tailwind modest; layoffs still a drag.

(Trivium framing)

Grammar (facts): ADP Sept −32k; ISM services employment 47.2; Challenger Sept cuts 54,064; Carlyle Sept +17k; ADP weekly to Oct 11 +14,250/week; seasonal interest +27% YoY, postings +2.7% YoY, “urgent” 2.1%.

Logic (inference): Concurrent sub-50 employment indices + negative/near-zero private trackers → very weak Sept; ADP weekly + modest seasonal lift → small Oct rebound.

Rhetoric (implication): Plan for soft hiring into Q4; recruiting conditions likely loosen, wage growth cools; policy debate tilts toward supportive stance if weakness persists. (WSJ economist surveys also foresee ~15k/month in 4Q on average.)

Self-reflection: I weighted ADP and ISM employment most for Sept (broad coverage + cyclicality) and used ADP weekly to anchor Oct, with Indeed and Challenger as context.