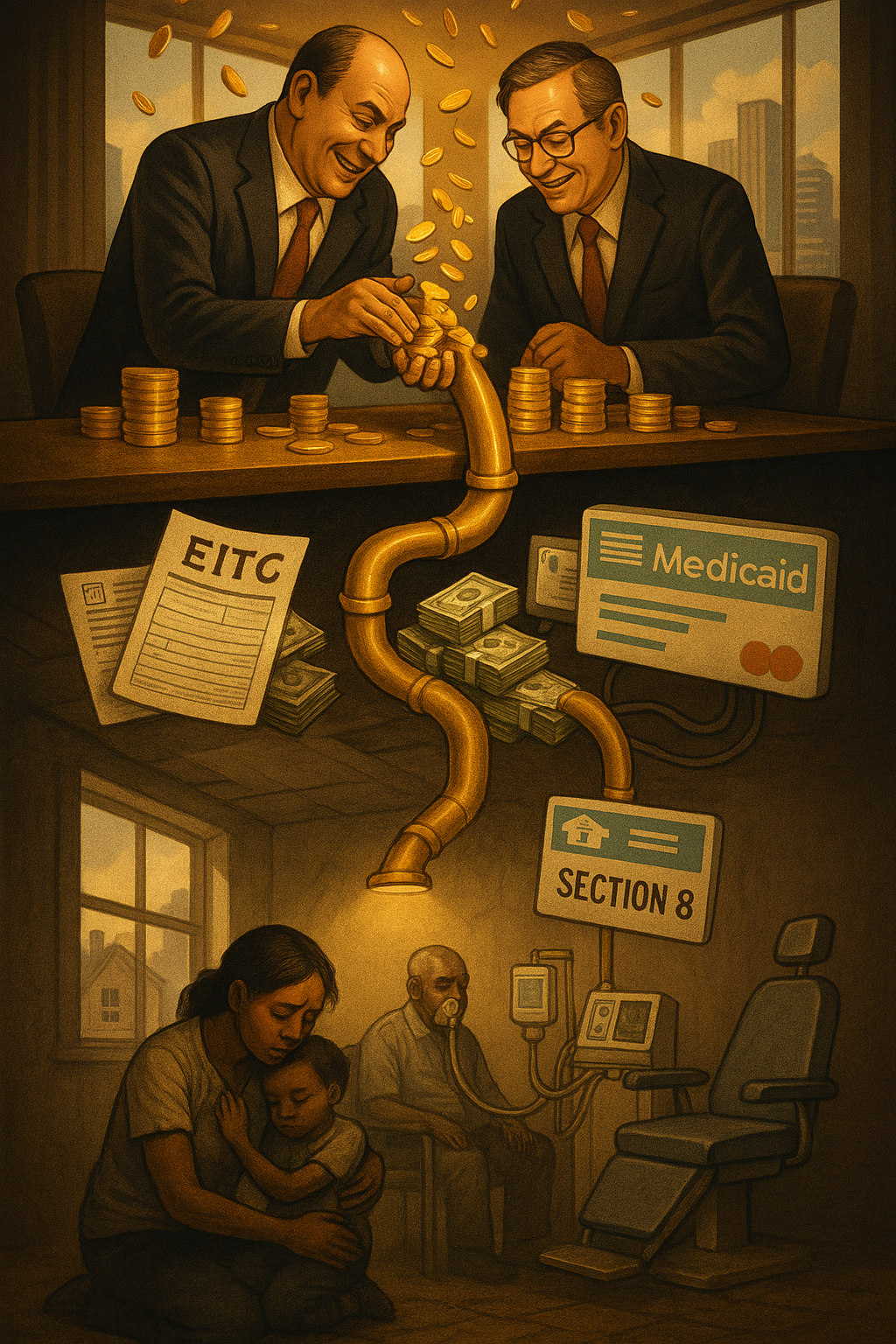

Who Gets Rich Off the Poor

How America's privatized welfare system created a trillion-dollar poverty industry where corporations profit from the vulnerable—revealing a betrayal of our founding principle that government should serve people, not corporate interests

A Comprehensive Analysis

Historical Context

In the 1950s, the poverty rate in America was around 22%, which was double what it is today. This led President Lyndon B. Johnson to declare an "unconditional war on poverty" in 1964. Following this declaration, social spending skyrocketed as a share of GDP, funding programs like Medicare, Medicaid, food stamps, and public education.

The War on Poverty initially showed promising results, with poverty declining 30% within five years. However, progress eventually slowed despite continued government spending. By the 1980s, economic challenges and taxpayer fatigue with funding social programs led to calls for reform.

President Ronald Reagan famously stated that "the federal government declared war on poverty, and poverty won." This sentiment, combined with the rising admiration for business efficiency in the 1980s, led to a fundamental shift in how welfare was administered. Rather than direct government assistance, welfare programs were increasingly privatized and outsourced to for-profit companies.

This privatization began under Reagan but expanded significantly during Bill Clinton's administration. The new model involved taxpayer money flowing to state governments, who then hired for-profit companies to distribute funds to eligible citizens. These companies were responsible for determining eligibility and ensuring the system wasn't being abused.

The rationale was that private businesses would be more efficient than government bureaucracy, reducing waste and preventing over-reliance on welfare. A key component of this system was requiring beneficiaries to be actively seeking employment or already working to qualify for benefits, with verification handled by these same private companies.

Tax Credit Skimmers

The Earned Income Tax Credit (EITC) is a vital tax benefit for low-income working people, especially those with children, potentially providing up to $7,000 in refundable credits. In many countries, claiming such benefits is straightforward, but in the United States, it requires navigating a complex 45-page instruction manual.

Due to this complexity, many eligible low-income individuals turn to tax preparation services like Liberty Tax. Investigation found that companies like Liberty Tax have been accused of:

- Luring low-income customers with promises of tax preparation assistance

- Secretly skimming money from tax refunds, including the EITC meant to support these vulnerable individuals

- Offering high-interest "refund anticipation loans" that function essentially as predatory payday loans secured by expected tax refunds

- Using non-transparent pricing structures to take advantage of low-income Americans trying to access benefits they're legally entitled to

This represents a failure of the tax system, where what should be a simple process of checking a box on a free government website has become a vehicle for corporate profit at the expense of those the program was designed to help.

Housing Exploitation

Section 8 housing is a program where the government provides vouchers to low-income people to subsidize their rent in privately-owned properties rather than building public housing. Some landlords have learned to exploit this system by:

- Artificially inflating rent prices well above market rates, knowing the government will pay

- Charging as much as $1,000 more per month than comparable non-subsidized units

- Taking advantage of poor government oversight to extract maximum profit

In Washington DC alone, an investigation by the Washington Post found that the government was overpaying thousands of apartments, wasting about one million dollars every month. This practice not only enriches landlords at taxpayer expense but also depletes assisted housing funds and distorts the housing market.

Corporate Middlemen

When welfare administration was privatized, companies like Maximus emerged to handle eligibility determination and benefit distribution. This sector has grown enormously—Maximus had revenues of $88 million in 1995, which grew to $500 million within a few years and reached $4.9 billion today.

While these corporate middlemen are theoretically more efficient than government, their profit motive creates problematic incentives:

- In Tennessee, after Maximus took over the state's Medicaid program, many children and elderly people were quickly deemed ineligible, leading to a 23% increase in uninsured children (the highest in any state at that time)

- In Kansas, after Maximus took over Medicaid administration, applicants faced huge delays in processing, creating backlogs that prevented vulnerable people from accessing healthcare for weeks or months

The key issue is that vulnerable populations are not these companies' customers—the government is. The companies are incentivized to:

- Win government contracts

- Cut costs to maximize profit margins

- Reduce staffing and process as few applications as possible

- Find people ineligible for benefits whenever possible to reduce their workload

While Maximus and similar companies aren't unusually profitable (with net profit margins around 3%), they do spend millions on lobbying and executive compensation while vulnerable populations suffer from reduced access to vital services.

Medicaid Dentistry Exploitation

Some dentists have built practices focusing exclusively on Medicaid patients, particularly targeting those less likely to advocate for themselves (low-income, disabled, or elderly patients). While regular private insurance typically pays more for dental procedures than Medicaid, volume-based practices can still be profitable if they:

- Perform as many procedures as possible, including medically unnecessary ones

- Target vulnerable populations who might not question treatment plans

- Bill for services not actually performed

Examples of this exploitation include:

- A North Carolina dentist who performed 17 root canals on a three-year-old child

- Kool Smiles, a Medicaid-focused dental franchise, paying nearly $24 million to settle allegations that they performed unnecessary procedures including tooth extractions, stainless steel crowns, and root canals on children who didn't need them

This type of exploitation not only depletes Medicaid funds but also subjects vulnerable patients to unnecessary medical procedures for profit.

Dialysis Industry Exploitation

Since the 1970s, the U.S. government has heavily subsidized dialysis treatment for kidney failure patients, creating an immediate business opportunity. Dialysis is meant to be a temporary intervention while patients await kidney transplants.

DaVita, one of the largest dialysis companies in the country, demonstrates how profit motives can distort patient care:

- Dialysis centers are paid per treatment (about $380 per session)

- This creates incentives to keep machines occupied at maximum capacity

- For-profit centers often operate with reduced staff levels

- Patients at for-profit centers experience higher death rates

- Most troublingly, patients at for-profit centers receive 17% fewer referrals for kidney transplants

This last point is particularly problematic: companies make more money by keeping patients on dialysis machines rather than helping them get transplants, which would effectively lose them a customer.

DaVita has paid approximately one billion dollars in settlements, including:

- $350 million for illegally paying doctors to recruit patients to their centers

- $450 million for billing the government for medicine they disposed of without using

These practices drain government funds intended to help vulnerable patients while potentially compromising patient outcomes.

Foster Care Fund Diversion

Perhaps the most troubling example involves foster children who have lost parents or have physical/mental disabilities. These children are entitled to approximately $700 monthly from federal Social Security funds.

States hire companies like Maximus to:

- Scan databases of foster children to identify which ones qualify for these benefits

- Divert that money from the children to state coffers

- States claim this money helps supplement their overall foster care programs

Companies like Maximus receive substantial fees for this service—reportedly $1,600 per child identified in Alaska. The scale of this diversion is significant:

- Washington State diverted $6.89 million from foster children (with Maximus's help)

- Wisconsin diverted $4.13 million (with Maximus's help)

- Illinois diverted $18.7 million (using another company called Diversified Services Network)

While this money technically still benefits the foster care system broadly, it was specifically intended to directly benefit these particularly vulnerable children personally.

Reclaiming Welfare Through the Moral Algorithm

The exploitation of vulnerable populations through privatized welfare systems represents a profound betrayal of America's founding principles. As John Adams declared, government should exist "for the common good; for the protection, safety, prosperity, and happiness of the people; and not for the profit, honor, or private interest of any one man, family, or class of men." This Moral Algorithm—the principle that government should serve the people over corporate interests—offers a framework for transformative reform.

Restoring the Moral Algorithm to Welfare Systems

True reform requires more than incremental fixes; it demands a fundamental realignment with the founding purpose of American governance:

- Dismantle the Poverty-Industrial Complex: Just as the Boston Tea Party rejected the East India Company's corporate privilege, we must challenge the corporate monopolies that have captured our welfare systems. Companies like Maximus, Liberty Tax, DaVita, and others have become the modern equivalent of colonial-era chartered monopolies, extracting profit from systems meant to lift people from poverty.

- Restore Public Accountability: The New Deal and postwar policies created the strongest middle class in American history by prioritizing public good over corporate profit. Similarly, welfare programs should be reclaimed as public services accountable to citizens, not shareholders.

- Break Corporate Control of Policy: The Powell Memo and subsequent corporate capture of governance has allowed profit-seeking entities to distort welfare systems. Reversing this requires ending corporate personhood in politics and removing profit incentives from decisions affecting vulnerable populations.

- Rebuild Economic Fairness: Just as FDR's administration created Social Security, broke up monopolies, and established worker protections, we must:

- End the diversion of foster children's benefits to state coffers and corporate middlemen

- Cap or eliminate profit margins on essential services like dialysis and Medicaid administration

- Establish strong penalties for predatory practices targeting welfare recipients

- Simplify tax credits for low-income Americans to eliminate predatory tax preparation schemes

- Revitalize Community Wealth Building: Instead of extractive corporate models, welfare systems should incorporate community ownership, non-profit administration, and local economic development to ensure resources circulate within communities rather than being extracted by distant shareholders.

The current welfare privatization model hasn't simply failed to deliver efficiency—it has enabled a massive transfer of public resources from the vulnerable to the wealthy. Just as the framers rejected economic arrangements that favored powerful corporations over citizens, we must reject systems that turn poverty into a business opportunity.