Cognitive vs. Concrete: Decoding the US-China Economic Showdown of 2025

While the U.S. bets on AI and sanctions, China builds a physical energy empire. In the race for global dominance, who has the winning long-term strategy?

TL;DR: Two Civilizations, Two Bets, One Decade

The United States is spending hundreds of billions to automate jobs that still exist, while China spends hundreds of billions to power factories for the next fifty years.

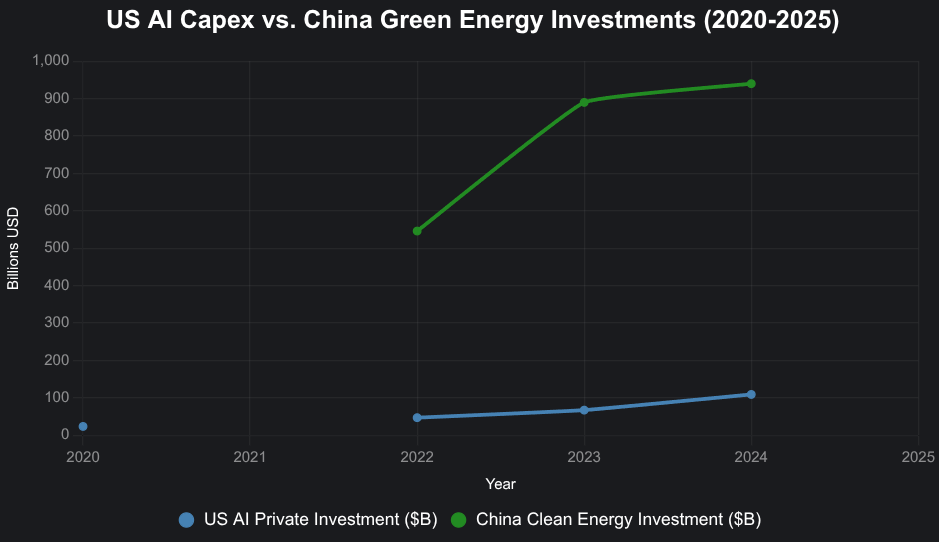

This is the uncomfortable arithmetic beneath the trade war headlines. America deployed a 198% surge in AI software investment during Q2 2025—the largest intellectual property boom since the dot-com era—yet 95% of businesses implementing AI see zero return on investment. Meanwhile, China activated hydroelectric infrastructure in Tibet that will generate more clean electricity than all of Poland, permanently, while producing it cheaper than anywhere else on Earth.

The American strategy concentrates returns: shareholders profit, workers lose hours. The August 2025 employment data reveals what economists call "hidden displacement", 9.7 million workers experiencing degraded job quality that doesn't register as unemployment. For every 100 people officially jobless, 130 others are trapped in part-time limbo, losing hours but keeping their job titles. This is what The Silent Layoff looks like at scale: not mass terminations, but mass diminishment.

China, conversely, builds dams that require human operators for decades. Physical infrastructure generates predictable employment; cognitive infrastructure explicitly reduces it. One nation is constructing the substrate of industrial power—the electricity that runs the factories, the energy that costs less than competitors can match. The other is building software with three-year shelf lives, hoping it generates productivity gains before obsolescence arrives.

The contradiction is structural, not ideological. Washington demands China stop buying Russian oil while America imports aluminum from countries buying the same oil. It threatens 100% tariffs on any nation trading through China while depending on those same nations as allies against Chinese expansion. It passes tax legislation adding $3.4 trillion to deficits while claiming to protect working families from global competition. It invests in AI tools that reduce worker bargaining power while arguing this serves the middle class.

The strategic question isn't whether AI will eventually transform productivity—it likely will. The question is whether transformation arrives before the infrastructure becomes obsolete, before the workforce hollows out, before allies abandon a strategy that punishes them for China's behavior, before the $800 billion revenue gap makes current investment rates unsustainable.

Deutsche Bank warns that without tech spending, "the U.S. would be close to, or in, recession this year." When one company—Nvidia—carries the weight of national economic growth, the system exhibits not strength but dangerous concentration masquerading as innovation.

China's bet: energy abundance determines manufacturing dominance. America's bet: cognitive infrastructure generates productivity gains faster than it displaces workers. One requires patience and cumulative capacity. The other requires perfect timing and flawless execution.

We're two to three years from knowing which civilization bet correctly. The invisible countdown has already started—and the August employment data suggests America's workforce is paying the entry fee whether the gamble succeeds or not.

The Secondary Tariff Ultimatum

Scott Bessent, serving in the US Treasury, issued a stark warning that represents a fundamental escalation in trade policy: any country purchasing Russian oil through China will face a 100% secondary tariff. This announcement was delivered publicly on CNBC, transforming what had been a bilateral US-China trade dispute into a global compliance ultimatum. The threat extends beyond China to include India, Germany, the entire G7, and any nation conducting energy transactions through China's industrial infrastructure. This represents a shift from traditional tariff policy to what amounts to extraterritorial economic enforcement, where the United States attempts to dictate the trading relationships of sovereign nations beyond its borders.

China's Strategic Infrastructure Development

In July 2025, China formally began construction on the Yarlong Changpo River hydroelectric dam network in Tibet, a project representing years of planning and preparation. The groundbreaking ceremony on July 19 preceded Bessant's tariff threats by ten days, underscoring that this massive infrastructure initiative reflects long-term strategic positioning rather than reactive policy. Five cascade dams will eventually generate 300 terawatt hours (TWh) of electricity annually when operational by 2033. This output represents three times the generating capacity of the Three Gorges Dam, which had previously been the world's largest power station. According to analysis of the project specifications, these dams alone will produce more clean energy than the entire nation of Poland. The juxtaposition of this infrastructure launch with escalating US trade threats illustrates a fundamental contrast in strategic approaches: while the United States deploys tariff threats as immediate economic leverage, China builds foundational infrastructure capacity designed to reshape competitive dynamics over decades.

The Scale of China's Sanctioned Energy Imports

China currently imports 2.2 million barrels of Russian crude oil daily, representing a 16% increase year-over-year according to Reuters data. Additionally, imports from Iran, another nation under US sanctions, have quietly expanded. Rather than concealing these transactions, Beijing has openly expanded its energy relationships with sanctioned nations. From Bessent's perspective, this trade activity does not constitute legitimate commerce but rather systemic collusion with sanctioned regimes. His framework paints the entire supply chain as complicit: oil flows into China, semiconductors and manufactured goods flow out to the world, and he now seeks European cooperation in blocking this exchange network.

The Fundamental Contradiction in US Strategy

Washington claims to protect the global order while simultaneously threatening to destabilize it through economic coercion. China's official position, articulated through statements to the South China Morning Post by the Chinese embassy in Washington, characterizes US sanctions as "illegally extraterritorial." Beijing insists its trade with Russia and Iran complies with international law and harms no third party. This argument invokes the principle of sovereign trade, the same principle the United States relies upon to justify its own global commerce. The contradiction creates a philosophical impasse: the US demands adherence to rules-based international order while unilaterally rewriting the rules to exclude its competitors.

The Chinese position has internal logic, though it is not immune to criticism. Energy markets are fungible by nature. Oil redirected to China still generates revenue for sanctioned regimes, which can then deploy those resources in ways the sanctions were designed to prevent. However, the principle China invokes regarding sovereign commercial relationships is the same framework that underpins American global trade.

Bessent's Evolving G7 Coordination Strategy

Bessent's approach has shifted from simple tariff implementation to pursuing coordinated G7 action designed to wall off China's entire supply chain. The strategy no longer targets only direct trade with China but threatens to penalize countries like Germany, France, and Italy if they fail to align with US demands. This represents an attempt to transform bilateral economic pressure into multilateral economic isolation.

The leverage dynamics favor American coercion. According to Wall Street Journal reporting, the European Union exports over $67 billion in vehicles and $130 billion in pharmaceuticals and metals to the United States annually. In contrast, US exports to Europe total only $70 billion. This asymmetric trade relationship creates substantial vulnerability for European economies. Bessent explicitly uses this imbalance as economic leverage, a tactic some analysts characterize as institutional blackmail disguised as trade policy.

The Transshipment Route Problem

China has adapted to tariff pressure by rerouting exports through third countries. According to Bloomberg Economics, approximately 70% of Chinese exports destined for the US now travel through intermediate nations including Vietnam, Mexico, and Canada. These transshipment routes obscure the true origin of goods, masking Chinese value-added production behind foreign labels and customs declarations. The practice represents a form of regulatory arbitrage, exploiting the complexity of global supply chains to circumvent direct tariff exposure.

To close this loophole, Bessent proposes blanket tariffs on entire nations, penalizing them not merely for importing Chinese components but for failing to actively reject them. If enacted, analysts estimate this policy could threaten over 2.1% of China's GDP while simultaneously causing severe economic damage to allied economies including Japan, South Korea, and Mexico. The unraveling of global supply chains would occur not through military conflict but through customs enforcement and regulatory compliance requirements.

The Domestic Cost of Tariff Policy

The contradictions multiply when examining domestic economic impacts. By targeting China, the United States necessarily raises consumer prices at home. The Congressional Budget Office has confirmed that American consumers paid billions of dollars more due to Trump's earlier tariff implementations. That revenue entered government coffers but was extracted from household budgets, functioning as a regressive consumption tax that disproportionately burdens lower-income families.

This creates a structural paradox: tariffs designed to protect American industries end up suppressing American demand. A 30% import tax on Chinese goods may sound aggressive in political rhetoric, but as Financial Times analysis demonstrates, US consumers, not Chinese exporters, absorb most of the cost. The Treasury collects the revenue while the public bears the price burden. This is not an accidental side effect but rather an inherent feature of how tariff mechanisms function in practice. Tariffs operate as domestic taxes disguised as punishment for foreign nations.

Trump's Tax Plan and Fiscal Implications

Trump's latest tax legislation adds an estimated $3.4 trillion to the US deficit over the next decade according to the nonpartisan Congressional Budget Office. Most benefits flow to corporations and high-income earners, while programs serving lower-income Americans face cuts. Medicaid, food assistance programs, and renewable energy credits are being reduced. By 2034, an estimated 10 million Americans could lose health coverage as a direct result of these policy choices.

The administration simultaneously claims to protect working families from global competition while implementing a fiscal framework that primarily benefits wealthy households and corporations. The contradiction is not ideological but structural, embedded in the fundamental design of the policy architecture.

The Logic Reset: Strategic Incoherence

When examined systematically, the strategy contains multiple layers of contradiction. The United States demands that China stop purchasing oil from countries the US itself cannot stop. To enforce this demand, it threatens its own allies, who are essential partners in any successful strategy to counterbalance China's rise. Punishing allies risks pushing them closer to Beijing's economic orbit. In attempting to isolate China, America may inadvertently isolate itself from its traditional partners.

Meanwhile, throughout this escalating tension, China continues building fundamental infrastructure. The Yarlong Changpo dam network is not metaphorical but literal power generation capacity. According to Chinese state planning documents, these dams will produce over 300 terawatt hours per year, representing nearly one-third of all European wind and solar output combined. This power does not merely fuel factories. It powers semiconductor foundries, data centers, and the entire industrial base required for advanced manufacturing.

The Energy Infrastructure Advantage

In May 2025, Jensen Huang, CEO of Nvidia, visited Beijing. His objective was to secure access to China's massive artificial intelligence market, which remains the largest in the world despite ongoing tensions. AI chips do not run on ideology. They run on electricity, and China's electrical grid is scaling faster than any Western counterpart. In 2024 alone, China produced over 10,200 terawatt hours of electricity, more than double US production according to International Energy Agency data.

China's expansion continues through multiple vectors: massive hydropower projects, extensive solar farm development in Xinjiang, and aggressive nuclear power plant construction. By 2030, China could achieve the world's cheapest industrial electricity rates. This represents a quiet but profound advantage in global manufacturing competition. Cost structures ultimately determine competitive positioning.

However, this transition occurs alongside continued fossil fuel development. China approved 66.7 GW of new coal-fired power capacity in 2024, reflecting the government's "build first, break later" approach to energy transition. Coal provides baseload reliability while renewable capacity scales, addressing energy security concerns for 1.4 billion people and the world's largest industrial base. This dual strategy ensures stable power supply during the decades-long transition to clean energy dominance, though it complicates emissions reduction timelines.

According to analysis by BloombergNEF and Carbon Brief, China invested between $818 billion to $940 billion in green energy infrastructure in 2024, depending on definitional scope. The higher estimate includes electric vehicles, batteries, rail infrastructure, and grid upgrades alongside renewable power generation, while more conservative estimates focus primarily on renewable energy installations. Even using the lower bound, this exceeds the combined investment of the next ten countries. The strategy is straightforward: dominate energy costs now to control global manufacturing capacity later. While the United States writes sanction frameworks, China builds turbines and power generation capacity. One side wields paperwork and regulatory threats. The other side rewires the physical infrastructure of industrial production.

Market Response and Commodity Dynamics

Financial markets are responding to this infrastructure buildout. Chinese cement, steel, and grid infrastructure companies have seen stock prices surge by 30% to 70% since January. Traders are positioning for surging domestic Chinese spending tied to dam construction and large-scale industrial upgrades. Iron ore prices are rising, and steel rebar futures have reached six-month highs. This is not speculative positioning but rather capital deployment responding to concrete government stimulus already moving through signed construction contracts.

Compare this to Washington's approach of threatening tariffs on goods routed through Vietnam. If implemented, these tariffs risk harming US allies and driving domestic inflation without meaningfully slowing Chinese industrial development. The true economic decoupling is not occurring at customs borders. It already happened in power generation capacity and energy cost structures.

The Semiconductor Narrative

The semiconductor story reflects similar contradictions. Washington attempted to block China's access to high-end chip manufacturing equipment and advanced processors. Yet according to Bloomberg reporting, domestic Chinese production of AI accelerators surged in 2025. Chinese chips are not yet competing directly with Nvidia's most advanced products in raw performance metrics, but they are scaling rapidly. What they lack in individual processing power, they compensate for through sheer production volume. As one US analyst told the Financial Times, "It's like watching someone build a slower Ferrari, except they're building 10 million of them."

Comparative Economic Performance

The first half of 2025 revealed starkly different economic trajectories shaped by fundamentally distinct structural dynamics. China maintained steady expansion at 5.2% in the second quarter and 5.3% for the first half overall, outpacing every G7 nation. This growth emerged largely from sectors including electric vehicles, robotics, and 3D printing, all industries powered by low-cost energy and strong state coordination. However, these headline figures benefit from deflationary dynamics: China's GDP deflator declined 1.2% year-over-year in Q2, marking the sharpest decline since the global financial crisis. This means real output growth appears stronger than nominal economic expansion, as falling prices inflate real GDP statistics. The deflationary pressures reflect overcapacity in manufacturing sectors and weak domestic consumer demand, creating underlying fragility beneath robust growth headline numbers.

The United States experienced dramatic volatility, contracting 0.6% in the first quarter before rebounding to 3.8% growth in the second quarter. This produced an overall first-half growth rate of approximately 1.6% annualized. The Q1 contraction was primarily driven by a 41.3% surge in imports as businesses and consumers front-loaded purchases ahead of anticipated tariff implementation. This represented a temporary distortion in trade patterns rather than fundamental economic weakness. The underlying measure of domestic demand, final sales to private domestic purchasers, grew 1.9% in Q1, indicating consumer and business spending maintained relative resilience despite policy turbulence.

The second quarter recovery proved equally dramatic. The 3.8% expansion stemmed from the reversal of Q1's import surge, with imports plunging 29.8% as the front-loading effect dissipated. Consumer spending accelerated significantly, and business investment in software surged at an extraordinary 198% annualized rate, driven primarily by corporate adoption of artificial intelligence technologies. This AI-related investment boom represented the strongest advance in intellectual property spending since the late-1990s technology expansion, suggesting genuine productivity-enhancing capital formation rather than purely speculative positioning.

The measurement frameworks themselves reveal conceptual differences: the United States reports annualized quarterly rates, projecting what growth would be over a full year if the quarterly pace continued, while China reports year-over-year comparisons measuring change from the same period in the prior year. This makes precise comparison challenging, though the directional contrast remains clear.

The fundamental distinction lies in underlying dynamics rather than headline figures. China's growth stems from state-directed industrial capacity expansion in strategic sectors, deliberately building manufacturing dominance in technologies essential for energy transition and advanced manufacturing. The expansion occurs amid deflationary pressures reflecting overcapacity and weak domestic consumer demand, characteristics of an economy optimizing for production capacity and export competitiveness rather than consumption-led growth.

American economic performance reflects the disruptive effects of rapid trade policy shifts creating temporary distortions in established supply chains, followed by genuine private-sector investment surges in transformative technologies. The volatility suggests an economy navigating structural adjustment, where traditional manufacturing competitiveness faces challenges while digital transformation and advanced service sectors demonstrate continued vitality. The sustainability of this growth pattern depends critically on whether AI-related investments translate into productivity gains sufficient to offset the drag from trade policy uncertainty and higher capital costs.

The AI Investment Paradox: Cognitive Infrastructure as Strategic Bet

The 198% surge in software investment during Q2 2025 represents far more than a quarterly statistical anomaly. It signals a fundamental strategic choice about how the United States attempts to maintain technological and economic leadership in an era of intensifying great power competition. This investment surge marks the strongest advance in intellectual property spending since the late-1990s IT boom, driven overwhelmingly by corporate demand for artificial intelligence capabilities and digital transformation infrastructure.

The scale of commitment is staggering. Microsoft alone plans to invest approximately $80 billion in AI-enabled datacenters during fiscal year 2025, with over half deployed within the United States. Goldman Sachs estimates that AI capital expenditures reached $368 billion through August 2025. This represents not incremental technological adoption but rather wholesale capital reallocation toward cognitive infrastructure, the computational substrate theoretically capable of redefining productivity across knowledge work.

The economic impact proves immediately measurable but structurally concerning. AI-related capital expenditures contributed 1.1% to GDP growth in the first half of 2025, with data center construction alone contributing one percentage point. Yet this dependency creates fragility. Deutsche Bank warns that "in the absence of tech-related spending, the U.S. would be close to, or in, recession this year," noting that Nvidia effectively carries the weight of U.S. economic growth. When a single company's capital goods sales become indispensable to national economic expansion, the system exhibits dangerous concentration risk.

The productivity promise versus implementation reality

Proponents invoke compelling productivity projections. Goldman Sachs estimates AI could boost GDP by 0.4% through the next few years and 1.5% cumulatively over the long run as adoption matures. Experiments across 18 knowledge-based tasks demonstrate productivity gains of 25% in speed and 40% in quality. A growing body of research confirms that AI boosts productivity and helps narrow skill gaps across the workforce. If these gains materialize across broad sectors, the investment surge would represent rational capital deployment toward genuinely transformative technology.

The implementation reality tells a substantially different story. A recent MIT study found that 95% of businesses that integrated AI into operations had yet to see any return on their investment. Of nine sectors examined, only media and technology experienced major structural changes. The research concludes with damning brevity: "adoption is high, but disruption is low."

The technical limitations explain much of this gap. Generative AI systems do not retain feedback, adapt to context, or improve over time. For mission-critical work, the vast majority of companies still prefer humans. Instead, employees deploy AI for relatively mundane tasks like email summarization and content drafting. This represents useful productivity enhancement but falls dramatically short of the transformative reorganization of work processes that would justify current investment levels.

McKinsey research estimates the long-term AI opportunity at $4.4 trillion in added productivity potential, but only 1% of companies consider themselves "mature" in AI deployment. The chasm between investment and maturity reveals that most organizations remain in experimental rather than transformational phases. They are spending as if revolution has arrived while operating as if evolution continues at historical pace.

The sustainability crisis and revenue gap

Multiple structural factors threaten the durability of current investment trajectories. Bain & Company calculates that $2 trillion in annual revenue is needed to fund computing power required for anticipated AI demand by 2030, but the world remains $800 billion short even accounting for AI-related efficiency savings. This arithmetic suggests current investment rates cannot be sustained without proportional revenue realization within a compressed timeframe.

The depreciation problem compounds sustainability concerns. Unlike 19th-century railroad infrastructure or mid-20th-century interstate highway systems that delivered value across decades, AI infrastructure depreciates rapidly. Computational capacity becomes obsolete within three to five years as newer architectures emerge. This creates a treadmill dynamic where companies must continually invest merely to maintain competitive positioning, without necessarily capturing cumulative value from prior capital deployment.

Strategist Gerard Minack identifies a "positive feedback loop" where firms selling capital goods immediately report profits in full, while firms buying capital goods depreciate costs over time. This accounting asymmetry temporarily inflates aggregate profitability. When the investment cycle ends, whether through rational reassessment or funding constraints, returns for AI hardware companies could collapse as they did for internet infrastructure providers like Cisco following the dot-com bust. After the TMT boom ended, returns for internet hardware companies collapsed.

Prisoner's dilemma dynamics and forced investment

The investment pattern exhibits classic game theory pathologies that transcend rational economic calculation. Cloud computing firms face a prisoner's dilemma where if one operator fails to invest, it risks losing business to competitors who forge ahead. Alphabet CEO Sundar Pichai stated that "the risk of underinvesting is dramatically greater than the risk of overinvesting," while Meta's Mark Zuckerberg acknowledged that misspending "a couple of hundred billion dollars" would be "very unfortunate" but preferable to falling behind.

This creates forced investment dynamics where companies cannot rationally withdraw even when returns remain uncertain, because competitive positioning depends on maintaining parity with rivals. European mobile operators faced identical dilemmas during the late-1990s telecom boom and massively overpaid for 3G spectrum. The parallel suggests current AI infrastructure investment may reflect competitive necessity rather than economic optimization.

The institutional investor dimension reinforces these dynamics. Large fund managers face career risk in avoiding AI exposure entirely. The fear of missing a genuine technological revolution often outweighs concerns about participating in a potential bubble. This creates self-reinforcing capital flows where the perceived cost of being wrong by underinvesting exceeds the cost of being wrong by overinvesting, even when the latter might generate larger absolute losses.

Distinguishing bubble from boom

Allianz's chief economist argues the current environment represents "less a bubble and more a boom underpinned by fundamentals," though one that remains "fragile and critically dependent on the durability of the AI trade". Several characteristics distinguish 2025 AI investment from late-1990s internet speculation, suggesting structural differences that could support more sustainable trajectories.

First, adoption is real rather than promised. 78% of organizations reported using AI in 2024, up from 55% the year before. Unlike dot-com era promises about future e-commerce adoption, AI tools deliver tangible operational utility today. Productivity enhancements may be incremental rather than revolutionary, but they are measurable and genuine. Companies are not investing based solely on abstract future scenarios but rather on demonstrated capability to automate specific workflows.

Second, established players with massive cash flows lead investment rather than venture-funded startups burning through capital in pursuit of unproven business models. The companies deploying hundreds of billions into AI infrastructure generate enormous operating cash flow from existing businesses. They can sustain investment cycles through temporary earnings compression rather than requiring continuous external financing. This creates greater resilience to sentiment shifts and funding disruptions.

Third, market selectivity persists. Sectors further down the AI adoption curve, including software firms seeking to monetize AI features, have lagged in stock performance, reflecting investor caution about mixed results from companies trying to embed AI into products and services. This suggests discriminating capital allocation rather than indiscriminate enthusiasm.

Yet concerning signals proliferate. Nvidia's recent investment in OpenAI has sparked what analysts characterize as "bubble-like behavior" concerns, with critics noting it resembles "having your parents co-sign on your first mortgage". This circular financing, where infrastructure providers invest in their own customers, typifies late-stage bubble dynamics where self-referential capital flows substitute for genuine external demand.

The bifurcated capital landscape

The capital expenditure outlook bifurcates sharply: software investment skyrocketed 198% while structures investment declined 7.5% for the sixth consecutive quarter. This reveals profound capital reallocation from traditional industrial infrastructure toward digital and cognitive infrastructure. Factory construction, commercial real estate, and physical industrial capacity receive diminishing investment while datacenters, software development, and computational infrastructure absorb growing shares of available capital.

The reallocation reflects genuine technological shifts but creates potential vulnerabilities. If AI investments fail to generate anticipated returns within a two to three year window, the economy faces not merely a technology sector correction but rather a fundamental misallocation of capital away from productive physical capacity. The opportunity cost becomes visible in retrospect: the factories not built, the infrastructure not modernized, the industrial capacity not expanded because capital flowed instead toward computational infrastructure that may have arrived before its applications matured.

Near-term outlook and critical tests

Gartner predicts 30% of enterprise generative AI projects will stall in 2025 due to poor data quality, inadequate risk controls, escalating costs, or unclear business value. RAND research indicates over 80% of AI projects fail. These failure rates, if sustained, would validate skepticism about whether current investment levels reflect rational assessment of near-term returns or rather represent competitive positioning absent clear path to monetization.

EY forecasts U.S. real GDP growth of just 1.7% in 2025 and 1.4% in 2026, with recession probability at 40% over the next twelve months. The AI investment boom provides temporary support but cannot offset broader headwinds from tariff disruption, policy uncertainty, and elevated interest rates that constrain credit availability. Companies face margin pressures, slower volume growth, and lingering uncertainty, making proactive risk management essential.

Deutsche Bank warns that "in order for the tech cycle to continue contributing to GDP growth, capital investment needs to remain parabolic". This trajectory is mathematically unsustainable. At some point, investment must transition from capital deployment to revenue generation, from building infrastructure to monetizing applications. The timing of this transition determines whether current investment represents prescient positioning or premature commitment.

Strategic implications: cognitive versus physical infrastructure

The 198% surge embodies a fundamental strategic choice. Where China builds hydroelectric dams, solar farms, and nuclear plants that will generate electricity for decades, the United States deploys capital toward cognitive infrastructure with three to five year obsolescence cycles. Where China invests in physical capacity that compounds across time, America bets on software and algorithms that require continuous reinvestment merely to maintain competitive positioning.

This represents not necessarily inferior strategy but rather fundamentally different risk-return profiles. Physical infrastructure delivers predictable, steady returns across long time horizons with limited upside volatility. Cognitive infrastructure offers potentially explosive upside if transformative applications emerge but carries higher risk of technological obsolescence and competitive disruption.

The strategic question is not which approach is correct in abstract terms but rather which approach better suits each nation's structural advantages and constraints. China possesses state capacity for coordinated long-term infrastructure investment and faces urgent need to provide reliable baseload power for massive industrial capacity. The United States retains advantages in software development, algorithm innovation, and high-risk capital formation but struggles with long-term physical infrastructure planning and coordination.

The sustainability of American strategy depends critically on whether AI investments generate sufficient productivity gains and revenue within a narrow window to justify continued capital deployment. If they do, the United States could achieve a genuine productivity renaissance, using cognitive infrastructure to maintain economic leadership even as physical manufacturing capacity concentrates elsewhere. If they do not, the economy faces potential contraction as the AI investment boom is revealed as unsustainable overinvestment in infrastructure that arrived before its applications matured.

The Silent Adjustment: Labor Market Quality Degradation

While aggregate GDP figures and AI investment statistics dominate macroeconomic narratives, the August 2025 employment data reveals a more subtle but consequential transformation occurring beneath headline stability. The labor market exhibits what can be characterized as quality degradation through compositional shifts, a pattern that validates concerns about whether massive capital deployment toward cognitive infrastructure translates into broadly shared prosperity or rather concentrates returns while dispersing costs.

The headline unemployment rate stands at 4.3%, representing approximately 7.4 million people. This figure suggests labor market resilience and supports arguments that the economy maintains sufficient momentum despite trade policy turbulence and elevated interest rates. However, this official measure captures only the most visible dimension of employment stress. A comprehensive assessment of labor market health requires examining what economists term hidden slack: the workers who remain employed but experience significant deterioration in job quality, compensation, or stability without appearing in unemployment statistics.

The hidden displacement multiplier

Beyond the 7.4 million officially unemployed, approximately 9.7 million additional workers face hidden forms of displacement. This category includes 4.7 million workers employed part-time for economic reasons who seek full-time positions but cannot secure them, 1.8 million marginally attached workers including 514,000 who have become discouraged and stopped searching, and an estimated 3.2 million among the 6.4 million not in the labor force who indicate they want employment but face barriers to active job seeking.

This arithmetic produces a striking ratio: for every 100 officially unemployed workers, roughly 130 additional workers experience hidden displacement. The total burden of job market stress proves approximately 1.3 to 2 times larger than headline unemployment figures suggest. This hidden slack does not register in conventional policy discussions or media coverage, yet it represents genuine economic insecurity affecting millions of households.

The pattern aligns precisely with research findings about AI adoption characteristics. The MIT study documenting that 95% of businesses implementing AI see no return on investment noted that "adoption is high, but disruption is low." Rather than eliminating positions entirely, AI tools enable employers to reduce hours, convert full-time roles to part-time arrangements, and diminish worker bargaining power by demonstrating that tasks can be accomplished with fewer labor inputs. The technology facilitates what might be termed employment hollowing: maintaining headcounts while extracting hours, benefits, and stability.

Compositional shifts and job quality signals

The August employment data reveals distinct sectoral patterns that illuminate underlying dynamics. Healthcare employment continues expanding, providing stable anchor jobs that support aggregate payroll statistics. Federal government employment contracts, reflecting DOGE-driven efficiency initiatives and budget constraints. Mining, quarrying, and oil and gas extraction similarly decline. Leisure sectors and goods-sensitive areas show mixed performance, with weakness concentrated in cyclical industries most responsive to demand fluctuations.

This composition shift toward lower-volatility anchor sectors like healthcare while cyclical private-sector employment stalls represents a late-cycle diffusion pattern. Broad-based employment growth gives way to concentration in defensive sectors with stable demand characteristics. Employers preserve core staff in essential functions while trimming hours and flexible roles in areas more sensitive to economic conditions.

Several granular indicators illuminate the quality dimension. Average weekly hours function as an early warning system: any drift lower reduces weekly compensation even when hourly wages hold steady, effectively implementing pay cuts without formal wage reductions. Temporary help services employment continues declining, signaling weaker hiring pipelines as firms reduce the most flexible portion of their workforce first. Transportation and warehousing weakness aligns with slower goods demand and compressed margins. The concentration of employment gains in government and healthcare sectors can maintain positive aggregate totals while private cyclical sectors cool substantially.

The implication: employers conserve resources by preserving bodies but reducing inputs. Workers retain jobs but lose hours, schedule flexibility, and bargaining leverage. This represents precisely the substitution pattern that AI tools enable at scale: not wholesale job elimination, but rather task redistribution that reduces labor inputs required for given output levels.

Wages, prices, and the purchasing power squeeze

Nominal wage growth averages approximately 4.1% overall, with job changers earning 4.4% increases and job stayers receiving 3.8% raises. These figures appear healthy in isolation, suggesting continued wage momentum and worker bargaining power. However, inflation context transforms the interpretation. Headline CPI inflation runs at 2.9% year-over-year, with core inflation near 3.1%. This produces real wage growth that remains slightly positive for median workers but with substantially cooled momentum relative to 2022-2023.

The deceleration proves consequential for household economics. During 2022-2023, real wages rose meaningfully as nominal wage growth substantially exceeded inflation, enabling households to rebuild purchasing power eroded during the initial pandemic-era price surge. The current configuration where nominal wages grow at 4.1% against 2.9-3.1% inflation generates minimal real gains, particularly for workers experiencing reduced hours or forced transitions to part-time arrangements.

This creates a subtle but pervasive squeeze: wages rise enough to avoid outright declines but not enough to generate meaningful improvement in living standards, while job quality deteriorates through reduced hours and diminished stability. The aggregate effect resembles slow-motion immiseration, a gradual erosion of economic security that remains largely invisible in headline statistics but accumulates meaningfully across millions of households.

The revision signal and survey divergence

Payroll data for June and July underwent combined downward revisions totaling 21,000 jobs. While relatively modest in absolute terms against a labor force exceeding 160 million workers, these revisions carry disproportionate signaling value. Systematic negative revisions indicate that initial optimistic assessments require subsequent correction as more complete data arrives, suggesting underlying momentum proves weaker than real-time indicators suggest.

More concerning, a divergence emerges between the household survey that calculates the unemployment rate and the establishment survey that measures payroll employment. These surveys employ different methodologies and typically show some variance, but widening gaps often precede turning points in business cycles. The household survey increasingly suggests weaker conditions than establishment payrolls indicate, a pattern consistent with the hidden slack expanding while headline employment figures remain superficially stable.

If this divergence continues widening, it would strengthen the case for slow-burn deterioration rather than either robust growth or sudden recession. The economy would be cooling through quality degradation and compositional shifts rather than through mass layoff events that generate clear recession signals. This ambiguous deterioration pattern challenges both policymakers and market participants accustomed to more distinct inflection points.

Leading indicators and forward trajectory

Multiple forward-looking indicators signal continued cooling. Temporary help employment continues declining, directly foreshadowing weaker hiring pipelines as firms reduce flexible staffing before cutting permanent positions. Each tenth-point decline in average weekly hours scales into significant hidden job reductions when aggregated across millions of workers. Quit rates and job opening statistics confirm reduced worker leverage and slower labor market churn as employees become more risk-averse about changing positions when alternative opportunities appear less certain.

The prime-age labor force participation rate remains stable but fails to improve, consistent with quiet cooling rather than either robust expansion or abrupt collapse. This stability at current levels rather than continued recovery toward pre-pandemic norms suggests the labor market has exhausted its post-pandemic normalization momentum without generating new sources of participation expansion.

These indicators collectively map a system degrading through margins and compositional mix rather than through discrete mass layoff events. The pattern resembles mechanical fatigue rather than structural fracture: cumulative small-scale deterioration that weakens overall integrity without producing obvious failure signals until substantial damage has accumulated.

Connecting employment patterns to AI investment dynamics

The labor market data validates several concerns raised about AI investment sustainability. First, the finding that 95% of businesses see no ROI from AI implementations yet adoption remains high suggests that AI tools primarily enable labor input reduction without proportional productivity enhancement. Companies deploy AI not because it generates dramatic efficiency gains but rather because it permits modest labor cost reduction through hours trimming, task redistribution, and workforce flexibility compression.

Second, the concentration of private-sector job growth in defensive sectors while structures investment declines for the sixth consecutive quarter illustrates the capital reallocation from physical industrial capacity toward cognitive infrastructure. The 198% surge in software investment occurs simultaneously with continued contraction in structures investment and weakening employment in goods-producing and transportation sectors. Capital flows toward AI and digital transformation while flowing away from traditional industrial capacity and the associated employment base.

Third, the pattern where workers retain jobs but lose hours and bargaining power aligns with the characterization of current AI tools as task-level rather than job-level substitutes. Generative AI excels at specific circumscribed tasks like email drafting, content summarization, and basic analysis but requires human judgment for integration, quality control, and decision-making. This creates the employment dynamic observed in August data: firms maintain headcounts while reducing hours and converting full-time positions to part-time arrangements as AI tools handle task components previously requiring full-time human attention.

Fourth, the modest real wage growth amid nominally healthy wage increases reflects the broader pattern where AI investment boom concentrates returns to capital while dispersing costs through labor market quality degradation. The companies making massive AI investments see stock prices appreciate dramatically. The workers whose tasks become partially automated experience hours reductions, diminished scheduling flexibility, and compressed bargaining leverage. The arithmetic of productivity gains, if they materialize, flows primarily to shareholders and executives rather than distributing broadly through the workforce.

Implications for recession probability and policy constraints

The August employment data reinforces EY's assessment that recession probability over the next 12 months reaches 40%. The labor market exhibits classic late-cycle characteristics: diffusion narrowing before topline declines, hours compression preceding layoff waves, temporary help reduction signaling weakening hiring pipelines, and wage growth decelerating while remaining nominally positive. These patterns historically emerge during the final phases of expansions before recession onset.

However, the quality degradation pattern creates distinct policy challenges compared to traditional recession dynamics. In typical recessions, mass layoffs produce rising unemployment that clearly signals distress and justifies aggressive monetary and fiscal intervention. The current configuration where headline unemployment remains stable while hidden slack expands creates ambiguity about appropriate policy response. The labor market appears simultaneously healthy enough not to warrant emergency intervention yet weak enough to generate genuine household economic stress.

This ambiguity proves particularly acute given inflation remaining above Federal Reserve targets. Core inflation at 3.1% significantly exceeds the 2% target, constraining monetary policy flexibility even as labor market quality deteriorates. The Fed faces the uncomfortable position where rate cuts to support weakening employment might reignite inflation, while maintaining elevated rates to control inflation accelerates labor market degradation. The traditional policy toolkit assumes either inflation or employment problems, not simultaneous moderate challenges in both dimensions.

The AI investment boom further complicates policy calculus. If massive capital deployment toward cognitive infrastructure eventually generates genuine productivity gains, it could resolve the inflation-employment tension by enabling output expansion without proportional labor input increases or price pressures. However, if current investment patterns represent infrastructure buildout ahead of viable applications, as suggested by the MIT finding that 95% of businesses see no ROI, then the investment boom itself becomes a source of economic fragility rather than a solution.

The silent adjustment in comparative context

China's labor market dynamics differ fundamentally from American patterns, though comprehensive data remains less transparent. Chinese employment concentrates heavily in manufacturing and industrial sectors supported by state-directed investment in physical infrastructure. The massive hydroelectric, solar, and nuclear power investments generate employment in construction, equipment manufacturing, and ongoing operations. These positions tend toward manual labor and technical roles rather than knowledge work susceptible to AI substitution.

The strategic implication: China's infrastructure-led growth model generates employment in sectors with clearer physicality and less immediate AI displacement risk, while America's cognitive infrastructure bet concentrates investment in technologies that actively enable labor input reduction. One model builds dams that require ongoing human operation and maintenance. The other builds software that explicitly aims to reduce human task requirements.

This divergence in employment generation characteristics compounds the fundamental strategic tension between the two approaches. Physical infrastructure investment creates predictable employment in construction, operations, and maintenance across multi-decade asset lifespans. Cognitive infrastructure investment concentrates gains through capital appreciation while enabling workforce reduction through automation. The employment implications flow directly from infrastructure type: energy systems require human operation, while AI systems reduce human requirements.

The August employment data reveals that the United States navigates not merely trade policy turbulence or investment cycle dynamics but rather a profound structural transformation where capital deployment patterns increasingly diverge from employment generation. The economy simultaneously pursues aggressive technological advancement through AI investment while experiencing labor market quality degradation that undermines household purchasing power and economic security. Whether this tension resolves through eventual productivity gains that broadly lift living standards or instead produces extended stagnation where technological advancement benefits narrow constituencies while dispersing costs remains the central economic question for the remainder of the decade.

The pattern observed in August data suggests the transformation proceeds through gradual quality erosion rather than dramatic discontinuity. Workers lose hours rather than jobs. Compensation growth continues but decelerates. Employment concentrates in defensive sectors while cyclical areas weaken. The system degrades at margins rather than breaking overtly. This silent adjustment may prove more consequential than sudden crisis precisely because its gradual nature permits normalization and adaptation rather than forcing urgent corrective action. The question becomes whether this represents a sustainable transition to a more productive economy or rather a slow-motion deterioration that eventually requires dramatic correction once accumulated strains exceed system resilience.

Collateral Damage and Strategic Arithmetic

Analysts at Bloomberg Economics estimate that aggressively targeting China's export rerouting through third countries could eliminate up to 70% of Chinese exports to the US. However, this strategy would simultaneously disrupt approximately $300 billion worth of trade with US allies. This represents substantial collateral damage in a strategy that has not yet produced clear strategic victories. Meanwhile, China continues transforming energy dominance into industrial manufacturing strength.

The Deeper Philosophical Contradiction

The United States is demanding that China follow rules that Washington itself no longer consistently honors. It calls for fair trade while unilaterally rewriting trade law frameworks. It criticizes foreign industrial subsidies while passing tax reforms that primarily benefit wealthy individuals and corporations while weakening domestic consumer demand. It punishes China for purchasing Russian oil while continuing to import aluminum from countries that purchase the same oil. This selective application of principles is framed rhetorically as global leadership.

The Race Against Time

Bessent's real opponent may not be China but rather time itself. By forcing an immediate confrontation, he attempts to delay a transformation already underway: an energy-driven restructuring of the global economic order. China's turbines are operational. Its GDP is expanding. Its factories are preparing for a world where tariffs do not define trade relationships but rather scale, energy costs, and production capacity determine competitive outcomes.

The West can sanction specific products and specific transactions. It cannot embargo fundamental capacity. It cannot sanction infrastructure that has already been built. It cannot tariff electricity that has already been generated. The strategic question is not whether China can be contained through trade policy, but whether the United States can rebuild its own industrial and energy infrastructure quickly enough to remain competitive in a world where energy abundance, not financial leverage, determines manufacturing dominance.

The fundamental tension remains unresolved: the United States has bet hundreds of billions on cognitive infrastructure with rapid depreciation cycles and uncertain monetization timelines, while China builds physical energy infrastructure with multi-decade operational lifespans and predictable returns. One strategy maximizes optionality and technological upside. The other prioritizes certainty and cumulative capacity.

The next two to three years will reveal which approach better serves long-term strategic positioning in an era of intensifying economic competition between fundamentally different development models. The 198% AI investment surge must translate into genuine productivity gains and revenue generation within this narrow window, or risk exposure as premature infrastructure buildout ahead of viable applications. Simultaneously, the silent adjustment in labor markets must reverse through broadly distributed productivity enhancements, or risk cumulative erosion of household purchasing power and economic security that eventually demands dramatic correction.

China's physical infrastructure generates predictable employment across decades while America's cognitive infrastructure concentrates returns through capital appreciation while enabling task automation. The divergence in employment generation characteristics, combined with the quality degradation pattern observed in August 2025 labor data, suggests the United States navigates a profound structural transformation where capital deployment patterns increasingly diverge from employment generation and broadly shared prosperity. Whether this transformation produces a genuine productivity renaissance or extended stagnation remains the defining economic question of the decade.