Record Profits, Mass Layoffs: The AI Lie Fueling Our Next Systemic Collapse

Economic analysis: The AI labor transformation is a bubble. Mass layoffs are rising with record profits, but 95% of AI projects fail. This divergence, driven by hype, signals massive systemic risk.

Economic Analysis: The AI-Driven Labor Market Transformation and Systemic Risk

Executive Summary

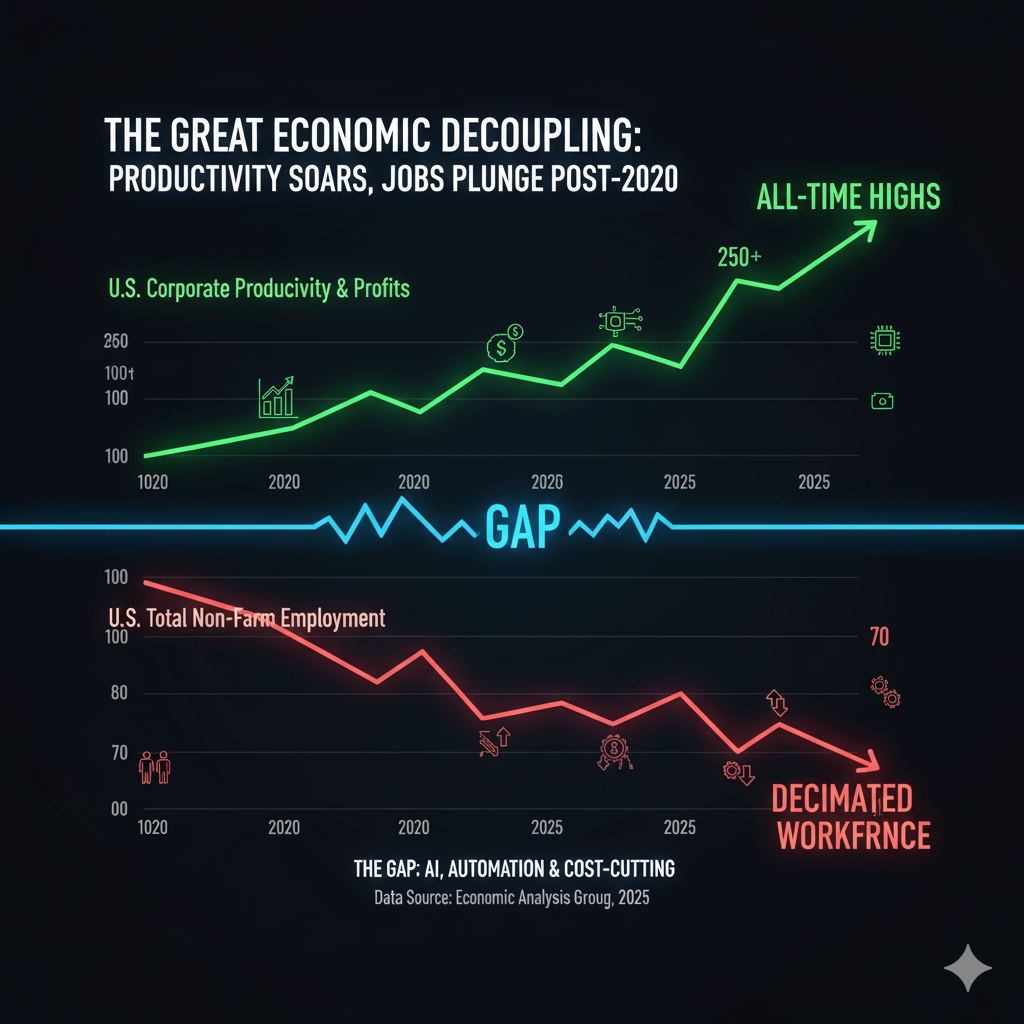

A historic divergence has emerged in the U.S. economy over the past three years: corporations are achieving record sales volumes and stock market valuations while simultaneously reducing their workforce through layoffs. This pattern is unprecedented in the 20-year dataset tracking these metrics, representing a fundamental shift in the relationship between corporate profitability and employment. The divergence between total sales in U.S. trade and manufacturing sectors and the inverted unemployment rate signals that companies are selling more goods and services than ever before while actively reducing their workforce. This phenomenon, coupled with accelerating AI-linked restructuring across industries, suggests society is entering a period of structural labor market transformation with potentially severe implications for economic stability, retirement security, and social cohesion.

The Historic Sales-Employment Divergence

For the first time in two decades, two critical economic indicators have diverged in a historically significant manner. Total sales made by U.S. firms in trade and manufacturing sectors have reached record highs, while simultaneously, the unemployment rate (when inverted for comparison) has been rising. This means corporations are generating more revenue than at any point in history at the exact moment they are laying off workers at an accelerating pace.

This divergence extends beyond sales volume to equity markets. The stock market has been thriving alongside rising unemployment for one of the first times in recorded history. Historically, strong stock market performance correlated with low unemployment, as robust corporate earnings typically required a healthy workforce. The breakdown of this relationship represents a fundamental shift in how corporations generate value—they are discovering ways to maintain or increase profitability while reducing their dependence on human labor.

This pattern indicates a major structural transformation occurring beneath the surface of the economy. The ability for corporations to automate processes and streamline costs using technology is no longer theoretical—it is happening in real time across multiple sectors.

Industrial Sector Precedent: The Manufacturing Story

The industrial sector provides a clear historical precedent for what may be unfolding across the broader economy. The U.S. Industrial Production Index, which measures the total output of goods, has remained near all-time highs despite some stagnation over recent decades due to globalization. America continues to produce a record amount of goods, demonstrating that production capacity has not diminished.

However, when examining total employment in the industrial sector, a stark picture emerges. Since 1980, there has been a complete decimation of industrial manufacturing employment. The number of workers in this sector has collapsed even as production remains at historic peaks. This apparent paradox—maximum production with minimal workers—demonstrates that technological displacement of labor has already taken complete effect in manufacturing.

Despite this workforce reduction, the industrial sector of the stock market has thrived over the past 20 years and currently sits at record highs. Investors have rewarded companies that successfully automated their production processes and reduced their labor costs, creating a powerful financial incentive for continued workforce reduction.

This manufacturing transformation has already created major societal disruptions: rising wealth inequality, the emergence of populism, and increasing political polarization. Many of these social phenomena can be traced directly to communities devastated by the loss of manufacturing employment—workers whose skills were made obsolete by automation and who had limited opportunities for economic recovery.

The AI Adoption Wave: Corporate Intentions and Workforce Reskilling

Current survey data reveals strong corporate commitment to workforce transformation through AI adoption. A CEO survey indicates that 4 in 10 business leaders expect to replace workers with AI by 2026—a timeline that is now imminent. Another survey found that 72% of business leaders believe AI will be the primary driver of workforce transformation over the next three years.

This is not merely speculative planning. Enrollments in AI reskilling programs have surged dramatically over the past two years for both businesses and individual consumers. This enrollment pattern demonstrates clear intention from both corporations and workers to adopt this technology and determine how it can increase productivity.

The reskilling dynamic presents particular danger for the labor market. With proper training in AI tools, it is entirely possible that one person can provide the same output that previously required four to five workers. This productivity multiplication effect follows a classic pattern of technological adoption.

Industrial production provides an illustrative parallel. Manufacturing was never 100% automated by machines, but one person operating machinery can produce significantly more output than multiple people working without mechanical assistance. AI represents a similar multiplier effect for knowledge work—the same fundamental economic principle applied to white-collar and service sector employment.

The pace of AI reskilling is accelerating rapidly, and this will very likely have major impacts on both employment markets and equity markets in various ways. However, the critical question is whether these impacts are already manifesting in current economic data or remain primarily a future concern.

Reality Check: The Small Business AI Implementation Failure

Recent research reveals a stark gap between AI expectations and implementation reality, particularly among small and medium-sized businesses. A MIT study found that 95% of businesses that attempted to implement AI are not generating a positive return on investment. The failure rate for AI implementation is extraordinarily high across the business landscape.

Another survey found that 55% of small business owners admitted to regretting their decision to replace human employees with AI systems. More than half of businesses that moved forward with AI-driven workforce reduction wish they had not done so, suggesting the technology has not delivered promised productivity gains.

When overlaying the Russell 2000 index (which tracks U.S. small-cap stocks and small businesses) against labor market indicators, there is no divergence similar to what appears in large-cap stocks. Small businesses in the United States have been stagnating since 2021, with earnings declining over this period. This performance has been much more reflective of the rising unemployment environment—small businesses are suffering alongside workers rather than thriving through automation.

The failure of AI implementation among small businesses, which represent a substantial portion of total U.S. employment, suggests that current workforce disruption may not primarily result from successful AI automation. If businesses are laying off workers but not achieving efficiency gains from AI, the economic disruption is occurring without the corresponding productivity benefits that would justify it.

The Large-Cap Technology Story: Alternative Explanations for Profit Growth

While small businesses struggle with AI implementation, large-cap technology companies have seen remarkable profit growth. The S&P 500, containing the largest companies in the United States, represents 50% of the U.S. job market and accounts for 90% of all corporate revenue generation in America. If these companies are successfully implementing AI while smaller firms fail, that could explain the observed divergence between stock market performance and employment.

Major technology companies—Nvidia, Meta (Facebook), Alphabet (Google), Amazon, and Microsoft—have seen their profit margins and earnings soar over the past several years. Notably, these companies have not been on hiring sprees, with the exception of awarding extremely large salaries to a small number of AI experts.

However, deeper examination suggests that profit margin expansion at these companies can be explained by factors unrelated to AI automation or AI-driven cost reduction:

Nvidia's Pricing Power: Nvidia has been charging extremely high prices for state-of-the-art AI chips that are in exceptional demand. This pricing power—the ability to command premium prices for scarce products—has expanded profit margins. This represents traditional supply-and-demand economics rather than AI automation reducing costs.

Meta and Google's Advertising Optimization: Both companies have managed to extract more revenue per advertisement shown to users. This represents optimization of existing business models and improved monetization of user attention rather than AI replacing workers.

Amazon Web Services Growth: Most of Amazon's earnings growth has come from Amazon Web Services (their cloud computing division) and their advertising business. Neither of these growth areas relates to AI automation of warehouse or retail operations.

Microsoft's Software Economics: Microsoft operates a software business with inherently low marginal costs. Their profit margins naturally expand as revenue grows because software can scale without proportional cost increases. This is a characteristic of software economics that predates AI.

None of these profit drivers relate to AI automation or AI-driven cost reduction. In fact, AI has functioned more as a cost center than a cost-saving measure for these companies. They are investing billions of dollars in AI infrastructure—data centers, specialized chips, research facilities—with no clear return on investment currently visible.

Current Labor Market Data: The October 2025 Reality

Recent labor market data, compiled from private sources during a government data blackout, reveals a deteriorating employment situation with modest signs of stabilization in October following significant weakness in September.

September 2025: Confirmed Weakness

Multiple independent data sources converged on a picture of labor market softening or contraction:

- ADP Report: The private payroll processor reported that U.S. private-sector employment dropped by 32,000 jobs in September, indicating actual job losses rather than merely slow growth.

- ISM Employment Indices: The Institute for Supply Management's survey of supply-chain executives showed services employment contracted in September for the fourth consecutive month (employment index: 47.2, below the 50 threshold that separates expansion from contraction). Manufacturing employment remained in contraction for the eighth consecutive month (index: 45.3).

- Carlyle Group Estimate: Data from this investment firm, based on employment at its portfolio companies, indicated 17,000 jobs were added in September—a significant slowdown from August's 22,000 jobs and a weak figure suggesting borderline stagnation.

- Economist Consensus: A Wall Street Journal survey of economists conducted in early October showed forecasters expecting only 15,000 jobs per month in the final quarter of 2025, reflecting dramatically reduced hiring expectations.

The preponderance of evidence suggests September 2025 employment was flat to slightly negative, with a best estimate around -10,000 jobs (range: -25,000 to +20,000).

October 2025: Tepid Rebound

Private data indicates modest improvement in early October, but the overall picture remains weak:

- ADP Weekly Estimates: ADP began releasing weekly job-gain estimates for October. Their data showed an average weekly increase of 14,250 jobs for the four-week period ending October 11. This implies monthly job growth of approximately 55,000—a modest rebound from September's losses but still historically weak.

- Seasonal Hiring Patterns: Data from Indeed's Hiring Lab showed a 27% year-over-year surge in job seeker interest for seasonal holiday positions. However, the number of seasonal job postings increased only 2.7% year-over-year, and the proportion of companies marking positions as "urgently hiring" was just 2.1% compared to approximately 10% at the late-2021 peak. This mismatch between worker interest and available positions suggests weak demand.

- Conflicting Signals: The lack of official Bureau of Labor Statistics data due to a government shutdown has led to conflicting signals from various private sources, making it difficult to establish clear economic direction with confidence.

The best estimate for October 2025 employment is approximately +55,000 jobs (range: +35,000 to +75,000), representing a weak recovery from September's contraction.

Year-to-Date Context: Historic Job Loss Announcements

Layoff announcement data through September 2025 reached nearly 950,000 cuts year-to-date—the highest total since 2020. While September showed a 37% month-over-month decline in announced cuts (54,064 cuts vs. August's higher figure), the cumulative year-to-date total remains at historic crisis levels.

This data suggests September's month-over-month improvement in layoff announcements may represent a temporary pause rather than trend reversal. The overall trajectory remains deeply concerning.

Mass Layoffs Across Industries: Scope and Scale

Major corporations across virtually every sector of the economy are announcing massive workforce reductions, demonstrating this is a broad economic transformation rather than a sector-specific adjustment:

Largest Workforce Reductions

- UPS: 48,000 employees across both management and operations roles. This is particularly striking because the layoffs are occurring just ahead of the holiday season—traditionally the busiest period for package delivery. The fact that UPS believes it can function without these workers during peak demand signals either dramatic efficiency improvements or severe miscalculation.

- Amazon: Up to 30,000 employees, with specific focus on corporate white-collar positions. The company has also stated intentions to ultimately replace 600,000 blue-collar warehouse workers through automation.

- Intel: 24,000 employees, representing a substantial portion of the semiconductor manufacturer's workforce.

- Nestle: 16,000 employees across its global operations.

- Accenture: 11,000 employees. As a consulting firm specifically hired by other companies to improve efficiency, Accenture's own workforce reduction suggests automation is affecting even firms that advise others on automation strategies.

- Ford: 11,000 employees in its automotive operations.

Additional Significant Cuts

- Novo Nordisk: 9,000 employees

- Microsoft: 7,000 employees

- PWC: 5,600 employees

- Salesforce: 4,000 employees

- Paramount: 2,000 employees

- Target: 1,800 positions, specifically white-collar corporate roles

- Kroger: 10,000 employees across retail operations

- Applied Materials: 1,444 employees

- Meta: 600 employees (following previous larger rounds)

Electric Vehicle Production Whiplash

General Motors is laying off 3,300 workers specifically associated with electric vehicle production. This reflects dramatic policy whiplash between presidential administrations. The Biden administration provided substantial incentives for both consumers and automakers to transition toward electric vehicles. The Trump administration reversed course 180 degrees in the opposite direction, eliminating many of these incentives and support structures.

Workers who retrained for EV production based on government policy signals are now being laid off because policy reversed direction. This exemplifies how policy volatility creates additional labor market disruption beyond technological factors.

AI as the Primary Driver: White-Collar Job Elimination

Wall Street Journal reporting indicates that tens of thousands of white-collar jobs are disappearing as "AI starts to bite." The embrace of artificial intelligence is identified as the primary factor behind workforce reductions, with executives explicitly stating they hope AI can handle work previously performed by well-compensated white-collar employees.

Types of Work Being Targeted

Companies are specifically targeting what they consider "grunt work" and administrative costs in departments like Human Resources and Legal. Entry-level positions face particular vulnerability because this is exactly the category of work that companies believe can be delegated to AI systems.

The elimination of entry-level positions creates a structural problem for career development. Traditional career progression assumed workers would enter organizations in junior roles, gain experience and institutional knowledge, then advance to positions requiring greater judgment and expertise. If entry-level positions are eliminated, this progression pathway collapses.

Corporate Motivations for AI-Driven Layoffs

Multiple factors drive corporate decisions to reduce workforce through AI adoption:

Wall Street Rewards: Stock prices surge when companies announce workforce reductions and commitment to AI implementation. Investors have pressured executives to operate more efficiently with fewer employees, creating powerful financial incentives for layoffs regardless of actual productivity gains from AI.

Anticipated Capabilities: Many companies that have not fully determined how to incorporate AI effectively are preemptively laying off workers because they anticipate being able to use AI in the future. They want the immediate stock price boost from announcing workforce reductions even if they have not yet achieved the efficiency gains to justify those reductions.

Economic Uncertainty: The erratic nature of current policy creates massive uncertainty for business owners, making them reluctant to make large-scale investments or expand their workforces. In an uncertain environment, companies default to cost reduction rather than growth investment.

Workplace Transformation for Remaining Workers

The remaining workforce faces deteriorating working conditions. Managers now supervise more workers with less time available for individual meetings and mentorship. Employees who keep their jobs receive much heavier workloads, working more hours for the same compensation while investors and executives capture the productivity gains as increased profits.

Companies claim increased productivity and decreased costs from AI implementation but are not lowering prices for consumers. The efficiency gains, whether real or imagined, flow entirely to shareholders and executives rather than being shared with workers through higher wages or with consumers through lower prices.

The College Graduate Employment Crisis

The National Association of Colleges and Employers reports that the college class of 2025 submitted significantly more job applications than the class of 2024 while receiving fewer job offers. New college graduates are filing thousands of applications and receiving minimal or no offers in return. The unemployment rate for recent college graduates continues to tick upward.

This represents a fundamental break from the traditional value proposition of higher education. For decades, a college degree served as a reliable pathway to stable employment and middle-class income. If graduates cannot find employment despite following prescribed educational pathways, the entire social contract around higher education and career preparation collapses.

The "Learn to Code" Irony

For years, displaced workers and young people were counseled to "learn to code" because technology jobs represented the "jobs of the future." This advice shaped career decisions for millions of people and influenced educational policy.

Now, coding and technology jobs are among the first positions being eliminated by AI, contradicting the guidance that shaped career decisions for an entire generation. The very skills that were supposed to provide career security are among the most vulnerable to AI replacement.

Long-Term Career Disruption

Recruiting firms report a surge in 40-year-old workers who have been laid off and cannot keep pace with technology that is outpacing their skill sets. These individuals have approximately 25-27 years until retirement age—nearly three decades of prime working years ahead of them.

The displacement of workers in their 40s creates a particularly severe problem. These workers are too young to retire, often have substantial financial obligations including mortgages and children's education, and face labor markets that increasingly favor younger workers with more recent technical training. They lack sufficient time to completely retrain for new careers, yet face decades without stable employment.

Human Stories of Economic Devastation

The 33-Year-Old Technologist in Texas

One documented case illustrates the human cost of this transformation. A 33-year-old father of three with technology experience spent 10 months searching for work in New Braunfels, Texas—an area with relatively low cost of living where housing should be affordable.

During this unemployment period:

- He applied to over 1,000 jobs without success

- To cover basic necessities (food, gasoline, utilities), he emptied his 401(k) retirement account, sold stocks, sold cryptocurrency holdings, and even sold the Pokemon cards he collected with his son

- His home entered foreclosure when he could not make mortgage payments

- He eventually found employment at a car dealership through a friend's personal referral (not through the formal job market)

- He now commutes more than 2 hours each direction

- He works from 8:30 AM to 9:00 PM on the sales floor

- He is considering working on his scheduled day off just to cover expenses

- He describes having zero work-life balance despite having three children

This occurred in a moderate cost-of-living area, not an expensive coastal city. The fact that someone with technology skills and experience ended up functionally bankrupt and working in automotive sales (a respectable profession but not what his skills and training prepared him for) illustrates the severity of labor market breakdown.

Historical Parallel: GM Plant Closures

This situation echoes the 2008 General Motors plant closures. Workers were informed they still had jobs but not in their communities—they had to relocate, often living in temporary shared housing while trying to maintain family connections. These were generational residents whose families and entire communities were decimated within a decade.

The suggestion is made that revisiting these areas nearly two decades later would document complete "soul-sucking" devastation that occurred when industrial employment vanished. The current AI-driven transformation may produce similar community-level destruction across a much broader range of industries and geographic areas.

Federal Reserve Policy and Economic Uncertainty

Interest Rate Decisions and Market Volatility

Federal Reserve Chairman Jerome Powell lowered interest rates for the second consecutive meeting, though the reduction was modest. When questioned about market expectations for another rate cut at the December meeting, Powell responded "far from it"—a phrase that immediately triggered market turmoil and erased some of the day's gains.

Powell's comments reveal that the straightforward phase of unwinding aggressive rate increases may be complete. He is managing a Federal Reserve committee with a growing number of officials questioning whether rate cuts are warranted at all given mixed economic signals.

Critical Data Blackout

A government shutdown lasting 25-26 days has resulted in a complete data blackout from the Bureau of Labor Statistics and other federal agencies that typically provide essential economic information. The Federal Reserve is essentially operating blind without reliable, comprehensive economic data.

This data blackout makes informed monetary policy decisions nearly impossible. The Fed must set interest rates that affect the entire economy without access to official employment statistics, inflation measures, and other critical indicators. This represents an unprecedented challenge for economic policymaking.

Tariff Policy Volatility

President Trump and President Xi recently met in South Korea for approximately 90 minutes, announcing a reduction in the overall number of China tariffs. However, markets largely priced this in beforehand as it was effectively telegraphed ahead of time.

The combination of factors—monetary policy uncertainty, lack of reliable economic data, and unpredictable tariff policy—creates an extremely challenging environment for business planning and economic forecasting. Businesses cannot make confident long-term investment decisions when policy direction remains unclear and economic data is unavailable.

The Investment Bubble Hypothesis

The observed divergence between stock market performance and employment may have little to do with actual AI automation success. AI-related stocks may be running far above the reality of what AI can actually deliver in the short term, representing a speculative bubble rather than fundamental value creation.

Large technology companies are investing billions of dollars in AI infrastructure with no clear return on investment currently visible. If AI fails to deliver promised productivity gains and cost reductions, these investments will prove to have been wasted capital. The companies making these investments will face significant write-downs, and their stock prices will adjust downward accordingly.

The concern is that when this bubble unwinds—when AI fails to deliver expected returns—the resulting market correction will be severe. Investors have bid up AI-related stocks based on expectations of future transformation. If that transformation fails to materialize or occurs much more slowly than anticipated, stock prices must adjust to reflect actual rather than imagined productivity gains.

This unwinding could cause substantial job losses entirely unrelated to actual automation. Companies that laid off workers in anticipation of AI efficiency gains will lack both the workers and the AI capabilities, forcing further restructuring. Stock market losses will destroy wealth held in retirement accounts and investment portfolios. The financial shock could trigger broader economic recession.

Short-Term vs. Long-Term Automation

Technological automation is a persistent theme that occurs continuously across all sectors, and it will certainly spread to the services sector as the workforce develops AI-related skills. This is a long-term trajectory that appears inevitable.

However, in the short term—the next 12-24 months—AI is much more likely to cause job losses through the unwinding of a financial bubble rather than through actual successful automation. Companies are eliminating positions in anticipation of AI capabilities that have not yet been realized. When these capabilities fail to materialize on expected timelines, companies will face the dual problem of inadequate workforce and inadequate automation.

This represents a critical distinction for both workers and investors. Long-term automation trends may justify workforce reduction, but short-term layoffs based on unrealized AI capabilities create unnecessary economic disruption without corresponding efficiency gains.

Structural Economic Analysis

The Total U.S. Bet on AI

The United States has placed an "entire bet" on AI across multiple dimensions:

- Stock Market Concentration: Equity markets are heavily concentrated in AI-related companies, with a small number of technology firms representing a disproportionate share of total market capitalization.

- Infrastructure Investment: Massive capital is flowing into data center construction, specialized AI chip manufacturing, and supporting infrastructure.

- Labor Force Restructuring: The workforce is being reorganized with the assumption that AI will successfully replace substantial human labor.

The assessment is stark: if AI fails to deliver on its promises, the economic consequences could exceed the 2008 Great Recession in severity. The economy is now structured such that its success depends almost entirely on AI validation.

The "Just the Beginning" Problem

Current AI technology, by most objective measures, "still really kind of sucks"—it has significant limitations and has not achieved the transformative capabilities promised by its advocates. AI systems make errors, require substantial human oversight, struggle with tasks requiring judgment and context, and often fail to deliver efficiency gains despite implementation costs.

Yet even at this early, relatively ineffective stage, the economy is already experiencing:

- Massive layoffs across industries

- Skyrocketing unemployment for college graduates

- 40-year-old workers unable to restart careers

- Complete elimination of career change possibilities

- People unable to achieve economic security despite "doing everything right"

If this is the employment impact when AI is primitive and largely ineffective, the implications of more advanced AI—if such advancement occurs—are potentially catastrophic for the labor force.

Best-Case Scenario

The most optimistic scenario is that AI never progresses substantially beyond its current limited state—that it continues to "kind of suck" and cannot accomplish significant work without extensive human support. In this scenario, there would be "some labor force disruption, but it's not cataclysmic."

However, the trajectory corporations are pursuing suggests they are attempting nothing less than a "revolution from the top"—a fundamental restructuring of economic relations between labor and capital, executed without democratic input or oversight.

Political Response and Democratic Implications

Absence of Political Response

Despite the UPS layoffs alone affecting 48,000 middle-class workers in management and operations positions just ahead of the holiday season, there has been virtually no response from major national politicians. These are workers who "did everything right"—maintained employment at a major corporation, likely had stable benefits and income—and lost their jobs without significant political attention or intervention.

The lack of political response to workforce restructuring of this magnitude suggests elected officials either do not recognize the severity of the transformation or do not believe they can or should intervene in corporate employment decisions.

Economic Polling and Party Standing

For the first time in recent years, Democrats have taken the lead in polling on which party is better positioned to maintain prosperity. However, the Democratic advantage is modest (plus-4 points), suggesting neither party inspires significant confidence in their ability to guide the economy through this uncertain era.

The Republican advantage on economic issues that existed in 2023 was likely due to Democrats being in power at that time. Now that Republicans control government, their economic approval is declining. This pattern suggests the electorate rewards the party out of power on economic issues regardless of actual policy competence—a concerning indicator that neither party is offering credible economic leadership.

The "Autopilot" Problem

Neither political party appears to have a comprehensive vision for or attention to the actual mechanisms that make society function. Economic policy appears to be on "autopilot," completely in the hands of corporate leaders rather than democratic institutions.

Citizens never had the opportunity to "weigh in on any of this" despite the massive implications for their economic security and life prospects. Critical decisions about AI deployment, workforce restructuring, and economic transformation are being made in corporate boardrooms without public debate or democratic oversight.

Sam Altman and Undemocratic Power Concentration

OpenAI CEO Sam Altman is cited as an example of concentrated, undemocratic power. He has sole authority to make critical decisions that affect society:

- Whether to introduce mass AI-generated content (including potentially harmful content) into public spaces

- How to handle mental health crises and suicidal ideation in AI interactions

- The pace and nature of AI deployment across industries

- The ethical boundaries and safety measures for AI systems

These decisions are made without democratic input, oversight, or accountability. This is characterized as both "amoral and undemocratic"—major societal decisions are being made by individuals accountable only to investors and shareholders rather than to the public affected by those decisions.

Historical Context: Reversal of Progressive Era Reforms

The Gilded Age (approximately 1870-1900) was an era of unconstrained corporate power—robber barons, monopolistic trusts, company towns, dangerous working conditions, child labor, and extreme wealth concentration. During this period, large companies did control many facets of workers' lives with minimal democratic oversight or worker protections.

The democratic response came after the Gilded Age, through multiple waves of reform:

- Progressive Era (1890s-1920s): Antitrust legislation, labor reforms, workplace safety regulations, and the beginnings of consumer protection

- New Deal (1930s-1940s): Social Security, collective bargaining rights, minimum wage, financial market regulations, and expanded federal oversight of corporate behavior

- Post-WWII Era (1940s-1970s): Strengthened labor unions, expanded social safety net, civil rights protections, and environmental regulations

These reforms established the principle that large companies should not control every facet of life and that democratic institutions should constrain corporate power to protect workers and the public interest.

The Neoliberal Reversal: The Powell Memo and Reaganism

The systematic dismantling of these protections began in the 1970s with the rise of neoliberal ideology. The 1971 Powell Memo - written by corporate attorney Lewis Powell (later appointed to the Supreme Court) to the U.S. Chamber of Commerce - served as a blueprint for corporate political mobilization. Powell called for:

- Aggressive corporate political activism

- Business funding of think tanks and academic programs

- Corporate influence over media and public discourse

- Coordinated efforts to shape policy and regulation in favor of business interests

This memo catalyzed decades of organized corporate political action that fundamentally reshaped American policy.

Neoliberalism, which gained dominance with Reagan in the 1980s (and Thatcher in the UK), established a new economic orthodoxy:

- Deregulation of industries and financial markets

- Privatization of public services

- Systematic weakening of labor unions

- Tax cuts prioritizing corporations and the wealthy

- "Shareholder value" as the singular corporate purpose

- Free market fundamentalism with minimal government intervention

- Characterizing regulations protecting workers or the environment as "burdens" on business

Over four decades, these policies successfully reversed many Progressive Era and New Deal reforms. Union membership declined from approximately 35% of the workforce in the 1950s to roughly 10% today. Corporate tax rates fell dramatically. Antitrust enforcement weakened. Financial deregulation accelerated. Worker protections eroded.

The current situation—where AI-driven workforce restructuring proceeds without democratic oversight or worker protection—represents the continuation and culmination of this 50-year neoliberal project. The corporate power to restructure the economy unilaterally, the influence of money in politics that enables pro-corporate policies, and the absence of meaningful labor protections all follow directly from the ideological framework established by the Powell Memo and institutionalized through Reaganism.

What appears as a recent phenomenon is actually the latest phase of a long-term transformation. AI simply provides new technological tools to advance the same fundamental agenda: maximizing returns to capital while minimizing constraints from labor or democratic governance. The parallel to the Gilded Age is particularly apt because neoliberalism has successfully recreated many Gilded Age conditions—extreme wealth concentration, corporate dominance of politics, and workers with diminishing power to resist unfavorable changes.

The "Real Great Replacement Theory"

Politicians and Oligarchic Interests

Current politicians are actively "funneling money and favors to a few giant corporations and a few oligarchs who want to make your labor irrelevant." This is characterized not as a conspiracy theory but as an openly acknowledged reality—government policy actively supports corporate efforts to reduce dependence on human labor.

The mechanism driving this is straightforward and legal: political donations, lobbying expenditures, and the revolving door between government and industry. Large technology companies and AI-focused firms spend hundreds of millions of dollars annually on lobbying efforts in Washington D.C. Corporate PACs (Political Action Committees) and individual executives make substantial campaign contributions to politicians who support favorable policies. Former government officials take lucrative positions at tech companies, while former corporate executives move into regulatory and policy-making roles.

This creates a system where elected officials are financially incentivized to prioritize corporate interests over worker protections. Politicians depend on corporate donations for campaign funding, making them responsive to donor preferences rather than voter needs. The result is policy that serves those who finance campaigns rather than those who cast ballots.

Subsidies for AI infrastructure, tax advantages for automation investments, and lack of worker protections all represent policy choices that favor capital over labor. These choices are being made deliberately by elected officials who are responding to the incentive structures created by campaign finance and lobbying systems. The influence is not hidden or conspiratorial—it operates openly through legal channels that allow corporate money to shape democratic outcomes.

Connecting Infrastructure to Job Loss

It is only a matter of time before people connect several concurrent phenomena:

- Rising electricity bills as data centers consume increasing energy

- Data centers being constructed across the country at an accelerating pace

- Increasing white-collar layoffs in professional sectors

- Amazon's stated intention to replace 600,000 blue-collar warehouse workers with automation

These phenomena are directly related—the infrastructure being built with public subsidy and causing utility cost increases is specifically intended to eliminate employment opportunities.

Blue-Collar Warehouse Work at Risk

Amazon warehouse jobs represent one of the few remaining opportunities for high school graduates without advanced degrees—physically demanding work, but paying $20-25 per hour and available without college credentials. The push to automate these positions out of existence eliminates even this pathway for workers without higher education.

If both entry-level white-collar positions (requiring college degrees) and entry-level blue-collar positions (not requiring degrees) are simultaneously eliminated, there are no clear pathways for young workers to enter the labor force and establish economic independence.

Radicalization Prediction

A powerful observation is made about future political radicalization: "You will never meet a more radicalized person than the person who did all the things, went to business school, took on all this debt or went to law school, took on all this debt and then there is nothing for them."

This describes people who followed every prescribed pathway for economic success—higher education, professional degrees, significant debt investment to fund that education—only to discover no employment opportunities awaiting them after completion. They followed the rules, made the sacrifices, incurred the costs, and received nothing in return.

This represents the reality now and the accelerating future. When people who follow all social rules and make prescribed investments receive no reward for doing so, they become understandably radicalized. They perceive—correctly—that the social contract has been broken, and they have legitimate grievances about a system that encouraged their investment then failed to provide promised returns.

Media Coverage and Public Awareness

Lack of Mainstream Coverage

Despite the magnitude of these layoffs and their societal implications, mainstream media coverage has been minimal. The question is raised: "Did you really hear about it anywhere?" The UPS story involving 48,000 job losses received little attention from major outlets beyond alternative media sources.

This lack of coverage means most Americans remain unaware of the scope and scale of workforce restructuring. Without broad public awareness, political pressure for intervention or policy response remains minimal.

Priority Misalignment

Political discourse focuses extensively on foreign policy issues and culture war topics while largely ignoring the fundamental economic transformation happening domestically. Tucker Carlson specifically stated he doesn't care about Venezuela right now, even as Senator Lindsey Graham discussed Venezuela as justification for potential intervention.

The point is that AI-driven job displacement represents an actual "imminent threat to the very foundations of who we are" as a society—a domestic crisis affecting millions of Americans directly—yet receives far less media and political attention than distant foreign policy concerns.

This represents complete misalignment between what politicians and media discuss and what materially affects citizens' lives. The conversations occurring in Washington and on cable news bear little relationship to the economic anxiety experienced by workers across the country.

Retirement and Investment Risk

Concentration in AI-Related Assets

Concerns about retirement security focus on Nvidia and similar companies representing concentrated risk in retirement portfolios. If the economy has placed an "entire bet" on AI, and individual retirement accounts mirror this concentration through index fund holdings, the failure of AI to deliver expected returns could devastate retirement savings for millions of people.

Most workers have no control over these investment decisions—their 401(k) and IRA accounts are typically invested in broad market index funds that reflect overall market composition. If market composition is dangerously concentrated in AI-related stocks, individual savers bear that risk without having made active decisions to accept it.

Systemic Risk to Retirement Security

If AI stocks undergo significant correction because promised productivity gains fail to materialize, the impact on retirement accounts could be catastrophic. Workers who followed financial advice to save consistently, invest in diversified index funds, and plan for retirement could see their savings substantially diminished through no fault of their own.

This represents a systemic risk to retirement security that extends beyond individual investment decisions to the structure of how retirement savings are invested in the American economy.

Summary and Future Outlook

The Fundamental Question: "What Are We Going to Do?"

A central theme throughout this analysis is the question: "What are we going to do about this?" This is not rhetorical but represents a genuine crisis requiring immediate attention and coordinated response.

Society is watching AI's intended purpose become clear—"to replace every single one of you"—and there is no coherent response or plan from political leadership, corporate management, labor organizations, or other institutions that might address this transformation.

Inevitable Popular Reaction

While there is no current organized response, there will inevitably be a reaction from people "looking at this landscape for themselves and their kids" who "literally don't know what to do to survive now because there's no entry level positions."

Certain job categories are being "eliminated completely," and workers face an environment where standard career advice has become obsolete. The traditional pathways to middle-class stability—education, skill development, hard work—no longer guarantee employment or economic security.

When people who follow prescribed pathways find those pathways lead nowhere, they lose faith in existing systems and become open to radical alternatives. This creates conditions for political instability and social upheaval.

The Existential Nature of the Crisis

This moment may be more significant than typical economic downturns or recessions. It represents a fundamental transformation in the relationship between labor, capital, and technology that could permanently alter the social contract defining post-industrial societies.

The comparison to the Gilded Age suggests society may be entering a new era where corporate power operates without democratic constraint, with potentially devastating consequences for social stability and individual economic security.

The last "Gilded Age" occurred in the 1920s, and "that did not work out so well"—a reference to the Great Depression that followed and the massive social upheaval, political extremism, and eventual global conflict that resulted from unconstrained capitalism and severe wealth inequality.

Trading and Investment Implications

From an investment perspective, participants in AI-related trades currently hold positions in companies like ACMR, ASML, Nvidia, and Applied Materials that have yielded impressive returns. However, participation is predicated solely on momentum—the recognition that prices are rising and trend-following strategies are profitable.

When momentum reverses—and the analysis suggests it will reverse—the AI trade could unwind "pretty violently." Investors who fail to recognize the turning point and exit positions appropriately could suffer substantial losses.

The warning is clear: AI-related investments are currently profitable but represent a speculative bubble disconnected from underlying fundamental value creation. Timing the exit becomes critical, and many investors will inevitably be caught in the reversal.

Conclusion

This analysis presents a comprehensive picture of economy in structural transformation, driven by a combination of AI hype, corporate cost-cutting, policy dysfunction, and concentrated economic power operating without democratic oversight.

The key findings:

- Historic Divergence: Corporate profitability and employment are diverging in historically unprecedented ways, with companies achieving record sales and stock valuations while reducing workforces.

- Weak Current Data: September 2025 saw actual job losses (approximately -10,000 jobs), with October showing only weak recovery (approximately +55,000 jobs). Year-to-date layoff announcements approach 950,000—the highest since 2020.

- Broad Industry Impact: Layoffs span all major sectors—technology, logistics, retail, manufacturing, professional services—indicating systemic transformation rather than sector-specific adjustment.

- AI Implementation Failure: 95% of businesses attempting AI implementation are not generating positive ROI, yet companies continue laying off workers in anticipation of future AI capabilities.

- Bubble Risk: Large technology company profits derive from factors unrelated to AI automation. AI represents a cost rather than cost savings, suggesting stocks may be dramatically overvalued relative to actual AI contribution.

- Human Devastation: Individual stories reveal complete economic collapse for workers who followed all prescribed pathways—education, skill development, job experience—yet find themselves unemployable and financially destroyed.

- Political Vacuum: Neither political party offers credible economic leadership or policy response to workforce restructuring. Critical decisions are being made by corporate executives accountable only to shareholders.

- Democratic Crisis: Society never consented to this transformation. Decisions with profound implications for economic security and social stability are being made without public input or democratic oversight.

- Radicalization Risk: People who invested in education and skills based on societal promises, only to find no employment opportunities, become legitimately radicalized and lose faith in existing institutions.

- Systemic Risk: The economy has placed an "entire bet" on AI across stock markets, infrastructure, and workforce planning. If AI fails to deliver, consequences could exceed the 2008 Great Recession.

The analysis concludes with stark assessment: short-term AI job losses will more likely result from financial bubble unwinding than from actual automation success. Long-term, automation will certainly transform employment, but current disruption reflects speculation and misallocation rather than genuine productivity gains.

For workers, investors, and policymakers, the message is clear: prepare for sustained labor market weakness, maintain risk buffers, and recognize that current economic structures are unsustainable and will require fundamental reorganization—whether through deliberate policy intervention or through crisis-driven collapse and reconstruction.