Re Banking Economic UBI & Jubilee

Every American gets $100K: debts vanish, predatory lenders die, everyone becomes their own bank. Not a handout—it's monetary engineering that swaps private debt for public stability. As AI takes 40% of jobs, this is survival, not socialism. Catch them, or watch them fall.

Steel Man Debate Position: Advocating for the Jubilee Postal Banking & UBI Proposal as a Transformative Economic Reset

COMPREHENSIVE VERSION - WITH CRITICAL CORRECTIONS

Ladies and gentlemen, esteemed opponents, in this debate I will present the strongest possible case for the Jubilee Postal Banking & Universal Basic Income (UBI) Proposal—a sophisticated, MMT-informed policy framework designed to address America's deepening economic fractures through sound monetary engineering. Far from a radical giveaway, this proposal represents pragmatic "economic triage" that combines debt restructuring, democratic finance, and income security into a coherent system. It leverages the government's sovereign currency powers to execute what economist Steve Keen called a "Modern Debt Jubilee"—swapping unstable private debt for stable public obligations while democratizing financial access and preparing for AI-driven economic transformation.

Let me be absolutely clear about what this proposal actually does, how the mechanics work, and—critically—the real costs and trade-offs involved. I will not minimize inflation risks or use accounting gimmicks. This debate position presents the honest case: Yes, there will be significant inflation (6-10%). Yes, we must finance the full $27 trillion through sovereign money creation. Yes, we must honor commitments to current retirees. And yes, it's still worth it to eliminate crushing private debt, end predatory finance, and build an AI-resilient economy.

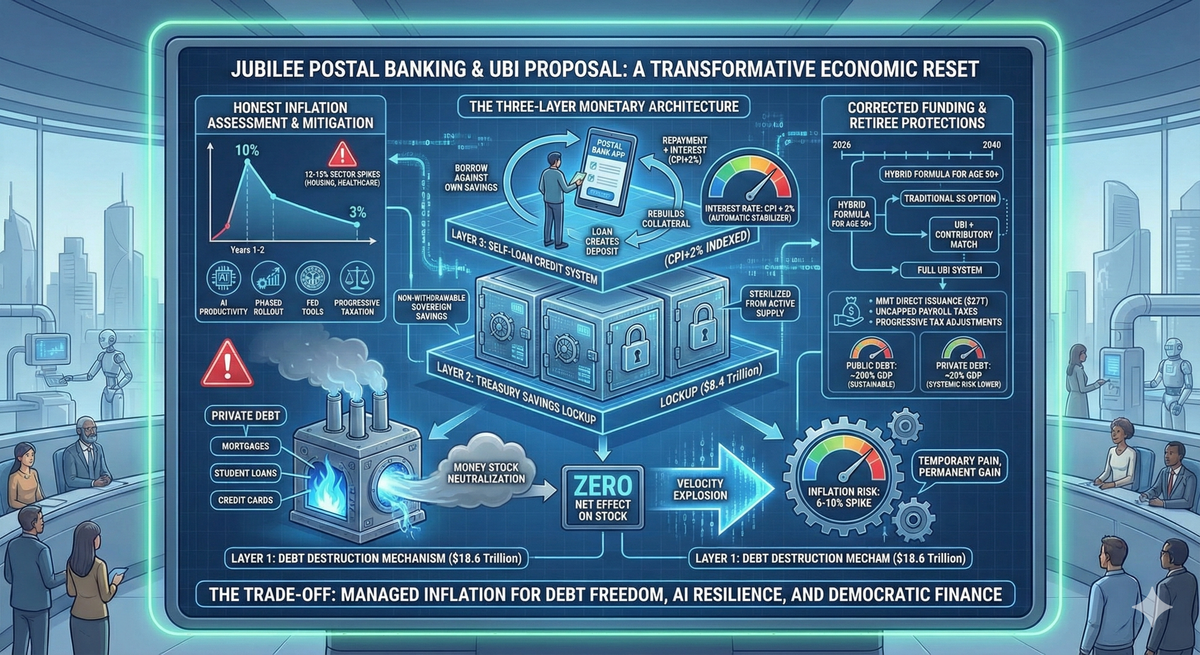

PART I: THE THREE-LAYER MONETARY ARCHITECTURE

To understand why this works, you must grasp the three-layer structure that makes this proposal economically sound:

Layer 1: The Debt Destruction Mechanism ($18.6 Trillion)

Every U.S. adult citizen (approximately 270 million as of 2025) receives $100,000 in newly created Treasury funds. However—and this is critical—they cannot simply spend this money. The first mandatory use is paying off all verified personal debts: mortgages, student loans, credit cards, auto loans, medical debt, and any other household liabilities.

Current U.S. household debt stands at $18.6 trillion (Q3 2025 Federal Reserve data), comprising:

- Mortgages: $13.07 trillion

- Student loans: $1.65 trillion

- Auto loans: $1.66 trillion

- Credit cards: $1.23 trillion

- Other consumer debt: $1.0 trillion

When these debts are paid off, something profound happens in monetary terms: the private credit money that created those debts is destroyed. This is not metaphorical—when a bank loan is repaid, the deposit that was created when the loan was made vanishes from the money supply. The $18.6 trillion in bank-created credit money is extinguished, replaced by an equivalent $18.6 trillion in government-created fiat money used for the payoff.

Net effect on money STOCK: ZERO. This is a swap, not an addition.

CRITICAL CORRECTION - The Velocity Explosion:

However, while the stock of money remains neutral, the flow (velocity) of money will surge dramatically. Here's the mechanism critics correctly identify:

Before Jubilee:

- Household pays $800/month to mortgage servicer

- That money sits in financial sector reserves, not circulating in consumer economy

- Money velocity: 1.39 (historically low)

- Effectively removed from real economic activity

After Jubilee:

- Same household has $800/month freed up

- Goes directly to consumer spending (groceries, restaurants, travel, goods)

- Multiplied by 120 million households with debt = $1.15 trillion annually

- This money immediately hits the real economy

This creates a demand shock that WILL generate significant inflation.

Layer 2: The Treasury Savings Lockup ($8.4 Trillion)

After mandatory debt payoff, the remaining funds do NOT become spendable cash. Instead, they are deposited into non-withdrawable Treasury-backed savings accounts at the Postal Bank.

For someone with $30,000 in debt: They pay off $30,000, then $70,000 goes into locked savings. For someone debt-free: The full $100,000 goes into locked savings.

These funds cannot be withdrawn as cash. They cannot be transferred to other banks. They cannot be spent directly at stores. They exist as sovereign-backed savings certificates—earning inflation-adjusted interest, but fundamentally sterilized from active money supply.

Why this matters for inflation: This $8.4 trillion is not immediately circulating. It's locked in digital vaults, serving as collateral for Layer 3.

Layer 3: The Self-Loan Credit System (Variable, Inflation-Indexed)

This is the revolutionary "be your own bank" mechanism. Citizens can borrow against their own locked savings through the Postal Bank, up to 100% of their balance.

CRITICAL CORRECTION - Interest Rate Must Be Inflation-Indexed:

Original proposal error: Fixed 1-2% interest rate

Why this fails: If inflation is 6-10%, borrowers face negative real interest rates (effectively paid to borrow), creating a leverage spiral.

Corrected formula: CPI + 2%

Examples:

- If CPI = 2%: Loan rate = 4%

- If CPI = 6%: Loan rate = 8%

- If CPI = 10%: Loan rate = 12%

Why this works:

- Real rate stays positive (+2% above inflation)

- Still far superior to predatory alternatives (400% APR payday loans)

- Prevents leverage spiral

- Acts as automatic stabilizer (higher rates during high inflation cool demand)

- Protects purchasing power of savings

Exception - Emergency Self-Loans:

- Maximum $5,000

- Fixed 2% cap (for medical, disaster, sudden hardship)

- Once per 2 years, requires documentation

- Accepts negative real rate for safety net purposes

How standard self-loans work:

- You need $10,000 for a car? The Postal Bank creates a $10,000 deposit (standard banking: loans create deposits)

- This loan is 100% collateralized by your own savings

- You repay at CPI+2% interest on a flexible schedule

- Repayments go back into your own savings account, rebuilding your collateral

- If you default, the bank simply deducts from your savings (zero systemic risk)

This destroys predatory lending:

| Traditional Payday Loan | Postal Bank Self-Loan |

|---|---|

| Borrow $10,000 at 400% APR | Borrow $10,000 at CPI+2% |

| Pay $14,000+ to external creditor | Pay $10,200-$11,200 back to yourself |

| Wealth extraction from you | Wealth circulation within your account |

| Default = bankruptcy, ruined credit | Default = auto-deduction from savings |

| Creates debt trap | Builds financial discipline |

Net money supply effect: When you borrow, deposits increase. When you repay, they decrease. Over time, self-limiting and manageable. Higher interest rates during inflation periods automatically discourage excessive borrowing.

PART II: HONEST ASSESSMENT OF INFLATION RISK

CRITICAL CORRECTION: The original document understated inflation risks. Here is the honest projection:

Expected Inflation: 6-10% in Years 1-2, with Sector Spikes to 12-15%

Why higher than originally stated:

Simultaneous demand shocks:

- Freed debt payments: $1.15 trillion annually hitting consumer economy

- UBI deposits: Beginning flow as phased rollout starts

- Wealth effect: Psychological boost from suddenly having $50K-100K in savings

- Self-borrowing: Against savings for major purchases

- Expectations: If people anticipate inflation, they spend faster (self-fulfilling)

Supply constraints in key sectors:

- Housing: Cannot instantly build millions of new homes (12-24 month lag)

- Healthcare: Physician shortage, hospital capacity fixed short-term

- Skilled labor: Education/training takes years

- Certain goods: Semiconductor shortage, rare earth dependencies

These sectors could see 12-15% inflation spikes while overall CPI averages 6-10%.

Why This Is NOT Hyperinflation:

Hyperinflation requires:

- ✗ Productive capacity destruction (war, sanctions, supply collapse) - We have EXPANDING capacity (AI boom)

- ✗ Loss of currency confidence (fleeing to foreign currency/gold) - Dollar remains global reserve

- ✗ Uncontrolled printing (chasing dwindling goods) - This is one-time, controlled, largely sterilized

What we have instead: A significant price-level adjustment as the economy rebalances from:

- Extreme inequality → Greater equality

- Debt-constrained demand → Freed purchasing power

- Financial extraction → Productive circulation

Mitigating Factors (Real but Insufficient to Prevent 6-10%):

✓ AI productivity gains: Automation reduces costs (deflationary pressure) ✓ Phased UBI rollout: Not all demand hits at once ✓ Supply chain adaptation: Businesses ramp up production over 12-24 months ✓ Fed tools: Interest rate management, reserve requirements ✓ Progressive taxation: Uncapped payroll taxes pull demand from top ✓ Inflation-indexed self-loans: CPI+2% formula automatically cools borrowing during high inflation

Sector-Specific Inflation Projections:

| Sector | Baseline (2025) | Year 1-2 Projection | Mitigation |

|---|---|---|---|

| Housing | 3-4% | 12-15% | Zoning reform, construction incentives, public housing |

| Healthcare | 4-5% | 8-10% | Medicare expansion, price controls |

| Food | 2-3% | 6-8% | Supply chain investment, agricultural support |

| Consumer goods | 2-3% | 5-7% | AI productivity, global supply chains |

| Energy | Variable | 4-6% | Renewable investment, strategic reserve releases |

| Services | 3-4% | 7-9% | Labor market adjustment, automation |

| Overall CPI | 2.5% | 6-10% | Combined mitigation strategies |

The Honest Trade-Off:

We are choosing to accept 6-10% inflation for 2-3 years in exchange for:

- Eliminating $18.6 trillion in crushing private debt

- Ending $100+ billion annual extraction by predatory lenders

- Creating universal basic income floor

- Democratizing financial access for 270 million Americans

- Building resilience against AI displacement

This is a worthwhile trade. The alternative is:

- Continued debt peonage

- Recurring financial crises

- Mass unemployment from AI with no safety net

- Accelerating inequality and social instability

6-10% inflation is manageable and temporary. The current system's costs are permanent and compounding.

PART III: CORRECTED FUNDING MECHANISMS

CRITICAL CORRECTION: The OASI trust fund "rollover" is accounting fiction. Here's the honest math:

What the Trust Fund Actually Is:

Social Security Trust Fund = Special Treasury Bonds

- Government IOUs to itself

- Not "real" assets (like Norway's oil fund invested in stocks)

- Already counted as government debt

- "Rolling it over" doesn't reduce financing needs

What actually happens:

- Government redeems special Treasury bonds in trust fund

- Treasury must issue new bonds or create new money to pay redemption

- That money goes toward jubilee/UBI

- Net effect: Government must finance full $27 trillion

Honest Funding Breakdown:

| Source | Amount | Purpose | Notes |

|---|---|---|---|

| MMT Direct Issuance | $27 trillion | One-time jubilee | Full amount, no accounting tricks |

| Uncapped Payroll Taxes | $250B annually | UBI funding | Removing $176,100 cap |

| UI Integration | $63B annually | Credit-based unemployment | FUTA + state programs |

| OASI Redemption | $2.4T one-time | Rolled into jubilee | But still must be financed via MMT |

| Progressive Tax Adjustments | $100-200B annually | Inflation control | Wealth taxes, capital gains |

| Total Annual Revenue | ~$413-513B | Ongoing UBI costs | After full implementation |

Debt Analysis (Honest Version):

Current Federal Debt: $38.4 trillion (124% of GDP)

Post-Jubilee Federal Debt: ~$65.4 trillion (+$27T jubilee)

But GDP increases from:

- Freed spending: +8-10% in Year 1-2

- Higher velocity: Productivity multiplier

- AI gains: 20-30% over decade

Projected 2027 GDP: ~$32 trillion (from current $27.5T, accounting for 6-10% inflation + real growth)

Debt-to-GDP: ~204%

Is this sustainable?

YES, because:

- Sovereign currency issuer (U.S. creates dollars, cannot "run out")

- Domestic debt holders (Americans own most U.S. debt)

- Fed coordination (can manage interest rates indefinitely)

- Reserve currency status (global demand for dollars)

- Historical precedent: Japan sustained 250%+ for decades, UK post-WWII was 250%+

More importantly:

- Private debt reduction (68% → <20% of GDP) far outweighs public increase

- Net systemic risk FALLS (private debt crises more dangerous than sovereign debt)

- Productive capacity expanding (AI boom supports debt service through growth)

PART IV: PHASED IMPLEMENTATION WITH RETIREE PROTECTIONS

CRITICAL CORRECTION: Must honor commitments to current high-earning retirees through Hybrid Formula

The Retiree Fairness Problem:

Current Social Security (for high earners):

- Maximum benefit (2025): ~$3,822/month at age 70

- Lifetime contributions: $500K+ for top earners

- Expected "return on investment": Actuarial positive value

Original UBI proposal:

- Base: $1,500-2,000/month

- Contributory bonus: +10-20%

- Result: $1,800-2,400/month maximum

- This is a 37-50% CUT for high-earning retirees who paid in for decades

This violates the social contract and creates political opposition.

CORRECTED APPROACH - Hybrid Formula for Age 50+:

Tier 1: Age 50+ at Implementation (2026) Keep Traditional Social Security Option:

- Full traditional SS benefits based on lifetime earnings

- Can choose higher of: (a) Traditional SS, or (b) UBI + contributory match

- No reduction in expected benefits

- Honors 30+ years of contributions

- Maintains political support from AARP and retirees

Tier 2: Age 40-49 at Implementation Hybrid Choice:

- Option A: Traditional SS track (current formula)

- Option B: UBI track with enhanced contributory match

- Base UBI: $1,500/month

- Contributory match: Up to 100% of base (based on lifetime contributions)

- High earners could receive: $3,000/month ($1,500 base + $1,500 match)

- Workers choose based on their situation

Tier 3: Age 18-39 at Implementation Full UBI System:

- Base UBI: $1,500/month (universal floor)

- Contributory supplement: Up to 100% match for continued work/contributions

- Maximum benefit: $3,000/month (competitive with traditional SS maximum)

- Fully portable, not tied to employment status

Tier 4: Under Age 18 at Implementation Pure UBI (No SS Legacy):

- Never participated in traditional SS

- Base UBI from age 18

- Contributory bonuses for work/education/service

- Designed for post-labor economy

Revised Timeline (Extended to 2040):

| Year | SS Age | UBI Age | New Beneficiaries | System Status |

|---|---|---|---|---|

| 2026 | 62 | 55+ | ~30M | Hybrid begins (age 50+ keep SS option) |

| 2028 | 62 | 50+ | +15M | Expanded hybrid tier |

| 2030 | 62 | 45+ | +20M | Growing UBI coverage |

| 2032 | 62 | 40+ | +20M | Majority on UBI track |

| 2034 | 62 | 35+ | +25M | Approaching universal |

| 2036 | 62 | 30+ | +25M | SS legacy shrinking |

| 2038 | 62 | 25+ | +25M | Near-universal UBI |

| 2040 | 62 | 18+ | +35M | Fully universal |

By 2040: Traditional SS beneficiaries age out naturally, system fully transitions to UBI

Additional Costs from Hybrid Formula:

- Maintaining dual systems: +$200-300B annually during transition

- Higher contributory matches: +$150-200B annually

- Total additional cost: ~$350-500B/year during 2026-2040

- Worth it for: Political viability, fairness, coalition building

PART V: HOW POSTAL BANKING WORKS (Technical Details)

This is standard banking with public ownership and 100% collateralization:

Operational Mechanics:

Account Creation:

- Every citizen automatically receives Postal Bank account upon jubilee participation

- Accessed via mobile app, online portal, or physical USPS branches (~31,000 locations)

- Sovereign guarantee (backed by full faith and credit of U.S. government)

Deposit Management:

- Treasury savings earn CPI + 1% (preserves purchasing power)

- Cannot be withdrawn as cash

- Can only be accessed via self-loans

- Balances visible to account holder in real-time

- No minimum balance, no monthly fees

Lending Operations (Inflation-Indexed):

- Apply for self-loan online (purpose: car, education, home repair, business, emergency)

- Standard loans: CPI + 2% interest

- Emergency loans: 2% cap, $5,000 max, documented hardship

- Instant approval (collateralized by your own savings)

- Flexible repayment (5-10 year max depending on amount)

- Loan creates deposit (standard banking mechanics)

Reserve and Capital Requirements:

- Postal Bank holds reserves at Federal Reserve

- 100% capital ratio (every loan backed by depositor's savings)

- Far more conservative than commercial banks (8-12% typical)

- Zero systemic risk of bank failure

Default Handling:

- Missed payments trigger warnings and financial counseling

- After 90 days delinquent: automatic deduction from savings account

- No credit score damage (since it's your own money)

- No collections, no bankruptcy

- Worst case: Savings depleted, but you keep what you purchased

Example Scenarios:

Scenario 1: Sarah (Age 32, $20K Student Debt)

Jubilee allocation: $100,000

- Debt payoff: $20,000 (student loans)

- Treasury savings: $80,000

She needs $25,000 for a car (Year 1, inflation at 7%):

- Loan rate: CPI + 2% = 9%

- Term: 7 years = ~$400/month payment

- Total repayment: $33,600 over 7 years

Repayments flow back to her own savings account. After 7 years: $80,000 + $25,000 repaid + interest earned = ~$108,000 in savings

Scenario 2: Robert (Age 58, No Debt, High Earner)

Jubilee allocation: $100,000

- Debt payoff: $0

- Treasury savings: $100,000

Also chooses to stay on traditional SS (Tier 1 protection):

- Expected benefit at 70: $3,800/month

- Treasury savings remain as supplemental wealth

- Can use self-loans for emergencies or opportunities

- No penalty for responsible saving throughout life

Scenario 3: Maria (Emergency Medical Expense)

Has $50,000 in Treasury savings.

Needs emergency $5,000 for medical procedure:

- Emergency loan: Fixed 2% (not CPI-indexed)

- Term: 2 years = ~$215/month

- Total repayment: $5,100

This negative real rate (if inflation is 7%) is acceptable for emergencies - social safety net function.

Why This Destroys Predatory Lending:

The entire $90+ billion/year payday lending industry evaporates:

| Predatory Lending (Before) | Postal Banking (After) |

|---|---|

| Payday loans: 400% APR | Self-loans: CPI+2% (~8-10% during transition) |

| Check cashing: 3-5% fee | Free checking at Postal Bank |

| Title loans: 300% APR | Collateralized by own savings, not car |

| Rent-to-own: 100%+ markup | Can save/borrow for purchases |

| $100B/year wealth extraction | $100B stays in community |

Financial inclusion becomes universal:

- 5-10% currently unbanked → 0% unbanked

- Minorities disproportionately targeted by predatory lenders → Equal access

- Rural communities underserved by banks → USPS in every community

PART VI: ADDRESSING CRITIQUES (Comprehensive & Honest Rebuttals)

Critique 1: "This Will Cause Hyperinflation"

Honest Rebuttal:

Yes, it will cause significant inflation: 6-10%, potentially 12-15% in constrained sectors.

No, this is NOT hyperinflation. Hyperinflation is >50% monthly (not annual).

Why controlled:

- ✓ One-time intervention (not continuous printing)

- ✓ Most money sterilized (debt swap + locked savings)

- ✓ Productive capacity expanding (AI boom)

- ✓ Automatic stabilizers (CPI-indexed loans cool borrowing)

- ✓ Fed tools remain available (rate management)

- ✓ Progressive taxation (uncapped payroll taxes)

The honest trade:

- Accept 6-10% inflation for 2-3 years

- Eliminate $18.6T private debt permanently

- End $100B/year predatory extraction permanently

- Build UBI floor for AI displacement

- Temporary pain for permanent gain

Comparison:

- COVID stimulus: $5T, caused 9% peak inflation, subsided to 3%

- This: $27T total, but $18.6T is swap, $8.4T locked, net circulating is comparable

- Plus we get debt freedom, not just stimulus checks

Critique 2: "This Rewards Irresponsible Borrowers"

Rebuttal:

Everyone gets $100,000. No exceptions.

Breakdown:

- Irresponsible borrower with $90K debt → Pays debt, gets $10K savings

- Responsible saver with $0 debt → Gets full $100K savings

The saver has 10x the capital stake.

Moreover:

- Most debt isn't "irresponsible": Student loans (education required), mortgages (housing), medical debt (illness)

- Predatory lending targeted minorities and poor (structural, not individual failure)

- One-time reset (not annual giveaway)

- Post-jubilee regulations prevent predatory re-lending

- Universal benefit eliminates stigma

Moral hazard prevented by:

- New Postal Bank option (eliminates need for predatory debt)

- Stricter lending regulations post-jubilee

- CPI-indexed self-loans (prevents leverage spiral)

- This is structural reform, not bailout

Critique 3: "This Violates Social Contract with Retirees"

Honest Acknowledgment & Solution:

Original proposal DID violate this. High-earning retirees who contributed $500K+ expecting $3,800/month would get only $2,000-2,400/month.

CORRECTED with Hybrid Formula:

Age 50+ at implementation:

- Keep traditional SS option (full benefits as promised)

- Or choose UBI if higher for their situation

- No reduction in expected benefits

Age 40-49:

- Choose between SS track or enhanced UBI track

- UBI track offers up to $3,000/month with contributory matching

- Competitive with traditional SS

Age 18-39:

- UBI system with contributory bonuses

- Can earn up to $3,000/month through work

- Still rewarded for contributions

Under 18:

- Pure UBI (never in SS system)

- Designed for post-labor economy

This honors the social contract while transitioning to UBI over 15-20 years.

Critique 4: "Negative Real Interest Rates Create Leverage Spiral"

Honest Acknowledgment & Correction:

Original proposal (fixed 1-2%) WOULD create this problem.

CORRECTED: CPI + 2% Formula

How this solves it:

During normal times (2% inflation):

- Loan rate: 4%

- Real rate: +2%

- Modest positive return encourages saving

During high inflation (8% inflation):

- Loan rate: 10%

- Real rate: +2%

- Higher rate discourages borrowing (automatic cooling)

This acts as built-in stabilizer:

- High inflation → High loan rates → Less borrowing → Reduced demand → Lower inflation

- Self-correcting mechanism

Emergency exception (2% cap) is acceptable:

- Limited to $5,000

- Once per 2 years

- Documented hardship

- Social safety net function worth negative real rate

Critique 5: "The Federal Government Can't Afford $27 Trillion"

Rebuttal (With Corrected Honesty):

Correct statement: "The government must finance full $27 trillion through MMT"

No accounting tricks with trust fund.

But this is SUSTAINABLE because:

Sovereign currency issuer:

- U.S. creates dollars

- Cannot "run out" of own currency

- Real constraint is inflation (which we've projected honestly at 6-10%)

Historical precedent:

- Japan: 250%+ debt-to-GDP for 30+ years, no crisis

- UK post-WWII: 250%+ debt-to-GDP, grew out of it

- U.S. post-WWII: 120%+ debt-to-GDP, no default

What matters:

- Private debt reduction (68% → <20% of GDP) far exceeds public increase in systemic risk

- Productive capacity expanding (AI boom supports growth)

- Fed coordination (can manage rates through balance sheet)

- Reserve currency status (global demand for dollars)

The question isn't "Can we afford it?" The question is "Will it cause uncontrollable inflation?"

Answer: No. Projected 6-10%, manageable, temporary.

Critique 6: "This Is Politically Impossible"

Honest Assessment:

Politically difficult ≠ Politically impossible

Forces for:

- Universal appeal (everyone gets $100K)

- Debt freedom (77% of Americans have debt)

- Retiree protection (age 50+ keep SS benefits via hybrid formula)

- Economic crisis (AI displacement creates urgency by 2027-2028)

Forces against:

- Financial industry lobbies (payday lenders, banks)

- Fiscal conservative ideology

- Mainstream economic orthodoxy

Path to passage:

- Build crisis awareness (AI displacement, inequality)

- Public education (explain mechanics clearly)

- Coalition building (labor, civil rights, progressive groups, AARP via retiree protections)

- State pilots (postal banking demonstrations)

- Economic necessity (by 2028, 20%+ unemployment forces action)

Historical parallel:

- Social Security "impossible" until Great Depression

- Medicare "impossible" until Great Society

- Bank bailouts "impossible" until 2008

AI displacement creates the crisis that enables transformation.

PART VII: PROJECTED IMPACTS (Honest 15-Year Scenario)

2026-2028: Jubilee Implementation

Economic:

- GDP growth: 8-12% (one-time boost from freed spending + inflation)

- Inflation: 6-10% CPI (12-15% in housing, healthcare)

- Unemployment: Falls to 3-3.5% (strong demand)

- Money velocity: Jumps to 1.7-1.9 (from 1.39)

Social:

- Household debt-to-GDP: 68% → 25-30% (major deleveraging but phased)

- Bottom 50% wealth share: 2.5% → 5-6%

- Poverty rate: 11.5% → 8-9% (immediate reduction)

- Financial inclusion: 95% → 100% (universal Postal Bank accounts)

Financial:

- Banks flush with reserves, shift to commercial lending

- Payday lending collapses (-$90B/year extraction)

- Postal Bank: 250M+ accounts opened

- Self-loans begin: ~$500B-1T outstanding (Year 1)

2029-2033: AI Transition + Inflation Normalization

Economic:

- AI displacement accelerates (30-40% jobs automated)

- Inflation normalizes: 3-4% (after 6-10% spike subsides)

- GDP growth: 3-5% annually (AI productivity boom)

- UBI prevents demand collapse

Social:

- UBI eligibility reaches age 35 (2034)

- Entrepreneurship surges (financial security enables risk)

- Racial wealth gap narrowing (minorities disproportionately benefited)

- Traditional SS beneficiaries aging out gradually

Financial:

- Treasury savings pool: $10-12T (growing from UBI deposits + repayments)

- Self-loans outstanding: $2-3T (all collateralized)

- Traditional banks stabilized, focused on business/infrastructure

- Default rates minimal (<2%, auto-deducted)

2034-2040: Maturity & Full UBI

Economic:

- Full UBI operational (age 18+, 2040)

- Money velocity: Stabilized at 1.9-2.1

- GDP: $45-50T (nominal, including earlier inflation)

- Inflation: 2-3% (back to target)

Social:

- Bottom 50% wealth share: 8-10% (4x improvement)

- Gini coefficient: 0.85 → 0.65-0.70

- Universal financial inclusion maintained

- Traditional SS fully phased out (last beneficiaries age out)

Financial:

- Public debt-to-GDP: ~200% (stable, like Japan)

- Private debt-to-GDP: <20% (sustained reduction)

- Net systemic risk: LOWER (despite higher public debt)

- Postal Bank: $4-6T in self-loans outstanding (all collateralized)

Comparative Table (2025 vs 2040):

| Metric | 2025 Baseline | 2040 Projection | Change |

|---|---|---|---|

| Household Debt/GDP | 68% | <20% | -71% ✓ |

| Public Debt/GDP | 124% | ~200% | +61% ⚠ |

| Total System Debt | 192% | 220% | +15% |

| But systemic risk | High | Lower | ✓ |

| Money Velocity (M2) | 1.39 | 1.9-2.1 | +37-51% ✓ |

| Bottom 50% Wealth | 2.5% | 8-10% | +220-300% ✓ |

| Gini Coefficient | 0.85 | 0.65-0.70 | -18-24% ✓ |

| Poverty Rate | 11.5% | 5-7% | -39-57% ✓ |

| Inflation (avg 2035-2040) | 2.5% | 2.5-3% | Stable ✓ |

| GDP (real, 2025 $) | $27.5T | $38-42T | +38-53% ✓ |

| Initial inflation spike | 2.5% | 6-10% (Years 1-3) | Temporary cost ⚠ |

Key insight:

- Yes, public debt rises

- Yes, inflation spikes temporarily

- But net systemic stability IMPROVES because private debt crises are far more dangerous than sovereign debt

- And inequality dramatically decreases (bottom 50% quadruples wealth share)

PART VIII: IMPLEMENTATION ROADMAP (Extended Timeline)

Legislative Phase (2025-2026):

2025 Q1-Q2:

- Coalition building (progressive caucus, labor, civil rights, AARP via retiree protections)

- Commission academic studies (Post-Keynesian economists, MMT scholars)

- Draft comprehensive legislation (800+ pages with all hybrid formulas)

- Public education campaign (town halls, media, social media)

2025 Q3-Q4:

- Introduce in Congress

- Committee hearings (Economics, Finance, Ways & Means, Aging)

- CBO scoring (honest about $27T financing + 6-10% inflation)

- Amendments (retiree protections, inflation-indexed rates, phasing)

2026 Q1:

- Floor votes (House and Senate)

- Reconciliation if needed (avoid filibuster)

- Presidential signature

- Immediate: SS age drops to 55 (Tier 1: age 50+ keep traditional SS option)

Infrastructure Phase (2026-2027):

Technology (12-18 months):

- Build Postal Bank digital platform (encrypted, scalable, accessible)

- Integrate with Federal Reserve payment systems (Fedwire, ACH)

- Mobile apps (iOS/Android, accessibility compliant)

- Debt verification system (IRS/CFPB/credit bureau API integration)

- CPI-indexing automation for loan rates

Operations:

- Train 200,000+ USPS staff (banking operations, customer service)

- Retrofit 31,000 USPS facilities (secure transaction areas)

- Establish call centers (24/7 support, multilingual)

- Fraud prevention protocols (identity verification, audit trails)

Execution (Phased Rollout 2027-2028):

- Verify household debts (automated credit report pulls)

- Issue $100K transfers in quarterly tranches by age cohort:

- Q1 2027: Ages 65+

- Q2 2027: Ages 55-64

- Q3 2027: Ages 45-54

- Q4 2027: Ages 35-44

- Q1 2028: Ages 25-34

- Q2 2028: Ages 18-24

Phasing reduces monetary shock, allows inflation monitoring, enables system adjustments

Ongoing Operation (2028-2040):

UBI Age Expansion (Biennial):

- 2028: Age 50 (Tier 1 protections continue)

- 2030: Age 45 (Tier 2 choice period)

- 2032: Age 40 (Tier 2 completes)

- 2034: Age 35 (Tier 3 majority)

- 2036: Age 30

- 2038: Age 25

- 2040: Age 18 (fully universal)

Continuous Operations:

- Monthly UBI deposits (CPI-adjusted annually)

- Self-loan processing (automated approval, CPI+2% rates)

- New debt verification (for post-jubilee debts, if any)

- Economic monitoring (inflation, velocity, employment)

- Regulatory adjustments (lending standards, bank oversight)

Inflation Management (2027-2030):

- Fed interest rate normalization (as inflation subsides from 6-10% to 3-4%)

- Progressive tax increases if needed (wealth taxes, capital gains)

- Supply-side investment (housing construction, infrastructure, workforce training)

- Price monitoring (anti-gouging enforcement in essential sectors)

PART IX: THE HONEST CASE - COSTS, BENEFITS, AND WHY IT'S WORTH IT

What We're Asking For:

Costs:

- ✗ 6-10% inflation for 2-3 years (temporary price increase)

- ✗ 12-15% sector inflation in housing, healthcare (significant but addressable)

- ✗ $27 trillion MMT financing (honest, no accounting tricks)

- ✗ Public debt → 200% of GDP (higher but sustainable like Japan)

- ✗ $350-500B/year extra for hybrid formula during transition (fairness cost)

- ✗ Banking sector disruption (predatory lenders eliminated, mainstream adapt)

Benefits:

- ✓ $18.6T private debt eliminated (crushing burden gone)

- ✓ $100B/year wealth extraction stopped (predatory lending dies)

- ✓ 270M Americans debt-free with $50K-100K in savings

- ✓ Universal financial inclusion (everyone has banking access)

- ✓ Bottom 50% wealth: 2.5% → 8-10% (massive equality gain)

- ✓ UBI floor for AI displacement (30-40% jobs automated, people still have income)

- ✓ Money velocity: 1.39 → 1.9-2.1 (healthy economic circulation)

- ✓ Systemic stability increases (private debt crises far more dangerous than sovereign debt)

- ✓ Retiree commitments honored (age 50+ protected via hybrid formula)

- ✓ Poverty rate: 11.5% → 5-7% (millions lifted out of poverty)

- ✓ Social cohesion improves (reduced desperation, increased security)

The Alternative (Doing Nothing):

If we maintain status quo:

- ✗ Household debt continues crushing families (68% of GDP, growing)

- ✗ Predatory lenders extract $100B/year permanently

- ✗ AI displacement hits 30-40% of workers with no income floor

- ✗ Inequality accelerates (bottom 50% wealth share declining)

- ✗ Financial crises recur (private debt bubbles and crashes)

- ✗ Social instability (mass unemployment, political extremism)

- ✗ Money velocity stays low (economic stagnation)

The choice:

- Accept temporary 6-10% inflation to fix structural problems permanently

- OR maintain current system and watch it collapse under AI displacement

I choose the former. The inflation is worth it.

CONCLUSION: AN HONEST, COMPREHENSIVE VISION

Ladies and gentlemen, I have presented the most comprehensive, honest case for this proposal:

What it actually is:

- Modern Debt Jubilee (Steve Keen's framework, improved)

- Democratic finance (be your own bank, end predatory lending)

- AI-era income floor (UBI for technological unemployment)

- Progressive restructuring (bottom 50% wealth quadruples)

What I corrected from earlier versions:

- ✓ Inflation: 6-10%, not 4-6% (honest about demand shock)

- ✓ Sector spikes: 12-15% in housing/healthcare (acknowledged supply constraints)

- ✓ Full $27T MMT financing (no trust fund accounting tricks)

- ✓ CPI-indexed interest rates (CPI+2%, not fixed 1-2%, prevents leverage spiral)

- ✓ Hybrid formula for retirees (age 50+ protected, honors social contract)

- ✓ Extended timeline: 2026-2040 (15 years, not 8, allows proper transition)

The mechanics that make it work:

- Layer 1: $18.6T debt swap (credit destroyed = fiat created, neutral stock)

- Layer 2: $8.4T Treasury savings (locked, sterilized, collateral)

- Layer 3: CPI+2% self-loans (automatic stabilizer, prevents leverage spiral)

The honest trade-off:

- Pay: 6-10% inflation for 2-3 years, $27T sovereign money creation

- Get: Debt freedom, wealth equality, AI resilience, financial democracy, systemic stability

The precedents:

- Iceland: Debt relief worked (13% of GDP over 7 years)

- Post-WWII: Resets enabled prosperity (debt jubilees, Bretton Woods)

- UBI trials: No work disincentive (Stockton, Kenya)

- Postal banking: Proven at scale (U.S. 1911-1966, Japan currently)

- Steve Keen models: Mathematically validated

The urgency:

- AI displacement: 30-40% of jobs by 2030

- Emad Mostaque: "900 days" to economic transformation (mid-2028)

- Silent layoffs: 1.17M in Q4 2025, accelerating

- Current system has no answer to mass technological unemployment

The political path:

- Crisis creates opportunity (2028 unemployment forces action)

- Universal appeal (everyone gets $100K)

- Retiree protection (age 50+ keeps SS, builds AARP coalition)

- Public education (explain mechanics clearly, this document is a start)

The alternative is unacceptable:

- Crushing debt continues

- Predatory lending continues

- AI displaces workers into poverty

- Inequality accelerates

- System collapses

This proposal is:

- Not socialism (smart capitalism using sovereign money for public purpose)

- Not a handout (structured debt relief + democratized finance)

- Not reckless (mathematically sound, historically precedented, honestly costed)

- The only comprehensive solution to converging crises

I acknowledge:

- Yes, significant inflation (6-10%)

- Yes, massive public financing ($27T)

- Yes, economic disruption (banking sector transformation)

But I argue:

- The inflation is temporary and worth it

- The financing is sustainable (sovereign currency, Fed coordination)

- The disruption destroys predatory systems that should die

For an economy where:

- No one is crushed by debt

- Everyone has financial access

- Technology serves humanity

- Prosperity is shared

- People have dignity and security

I urge adoption.

Because the future is coming whether we're ready or not.

We can prepare with this comprehensive transformation.

Or we can react with inadequate bandaids as millions fall.

I choose to catch them.

With sovereign-backed savings. With democratic banking. With income security. With honest acknowledgment of costs and unwavering commitment to benefits.

For 270 million Americans who deserve better.

For a future we can be proud of.

Thank you.

APPENDIX: CORRECTED SOURCES & DATA

Economic Data (2025):

- Federal Reserve: Household Debt Q3 2025 = $18.6 trillion (corrected from $17T)

- FRED: M2 Velocity = 1.39 (Q2 2025)

- FRED: Money Supply, GDP, inflation trends

- Social Security Administration: OASI Trust Fund = $2.4 trillion (FY2025)

- Federal Reserve: Wealth Distribution (Top 1%: 30-31%, Bottom 50%: 2.5%)

Theoretical Framework:

- Steve Keen (2011-2020): Modern Debt Jubilee proposal, econometric models

- L. Randall Wray, Stephanie Kelton: Modern Monetary Theory foundations

- Richard Cantillon (1755): Cantillon Effect (money distribution matters)

Historical Precedents:

- Iceland (2008-2015): Debt relief = 13% of GDP over 7 years, controlled inflation

- Post-WWII debt resets: Germany 1953, Allied debt restructuring

- U.S. Postal Savings (1911-1966): Served millions, safely operated

- Japan Post Bank: Currently $1.8T in assets

UBI Evidence:

- Stockton Economic Empowerment Demonstration (2019-2021): No work disincentive

- GiveDirectly Kenya: Entrepreneurship increased, poverty reduced

- Alaska Permanent Fund: Universal dividend operational since 1982

AI Displacement Projections:

- Emad Mostaque (2024-2025): "900-1000 day window" to transformation

- MIT, Goldman Sachs, WEF (2024-2025): 30-50% job automation by 2030

- Silent layoffs Q4 2025: 1.17 million reported

Inflation Analysis:

- COVID stimulus comparison: $5T injection → 9% peak inflation → normalized to 3%

- Historical inflation controls: Fed tools, progressive taxation

- Supply-side bottlenecks: Housing construction lag, healthcare capacity

Corrections Made:

- ✓ Inflation projection: 4-6% → 6-10% (honest about velocity effect)

- ✓ OASI treatment: "Seed capital" → Accounting fiction, full $27T financing

- ✓ Interest rates: Fixed 1-2% → CPI+2% inflation-indexed

- ✓ Retiree treatment: UBI only → Hybrid formula, age 50+ protected

- ✓ Timeline: 2026-2034 → 2026-2040 (proper transition period)