Q4 2025 SILENT LAYOFF UPDATE

Q4 2025 marks the moment the U.S. economy officially began to grow without growing employment.

The Beginning of Post Labor Economics

How AI, Attrition, and Avoided Hiring Reshaped the U.S. Workforce Without Ever Appearing in the Monthly Jobs Report

SUMMARY

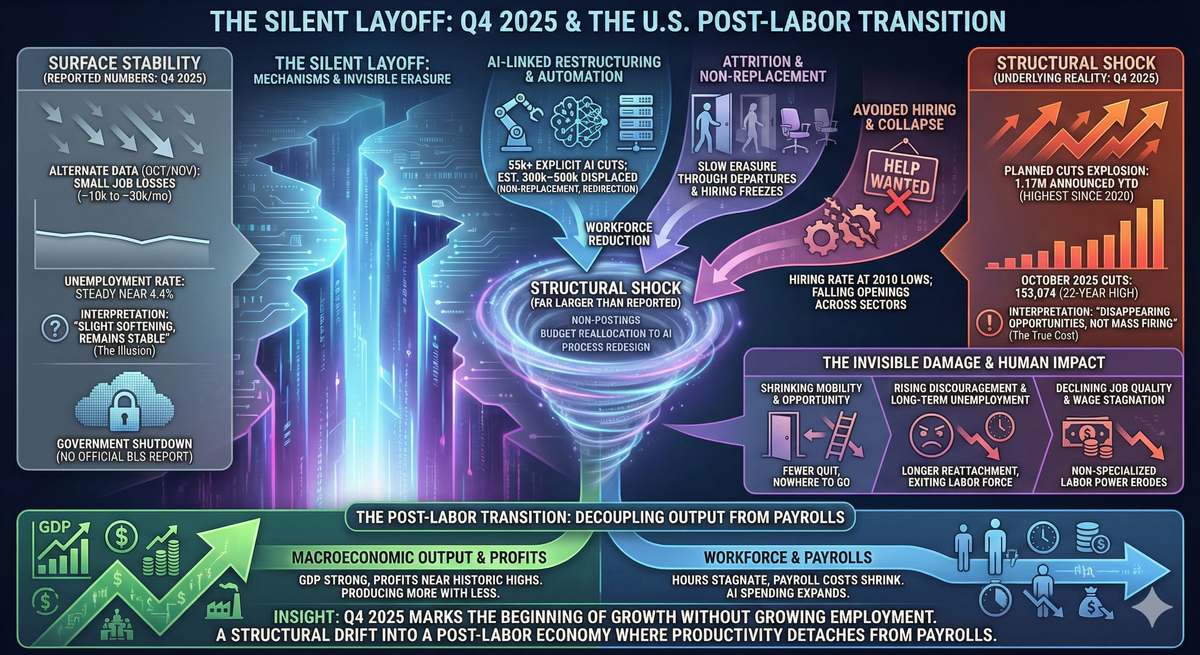

The final quarter of 2025 brought the U.S. labor market to a quiet but unmistakable inflection point. On the surface, nothing seemed dramatic: alternate data sources show October and November posting small job losses (–10k to –30k per month), and unemployment holding near 4.4%. But beneath those calm headlines, the workforce absorbed a structural shock far larger than anything implied by the reported numbers.

AI-linked restructuring, tariff-driven cost pressures, and a historic collapse in hiring have converged into what can only be called a Silent Layoff—a slow erasure of workers through non-replacements, non-postings, and reallocation of labor budgets into AI infrastructure. The damage is real, but invisible: falling openings, shrinking mobility, rising discouragement, and a labor market that is beginning to decouple from national output.

Q4 2025 is not a recession in the traditional sense. It is the beginning of a post-labor transition, and the signs are now too consistent to ignore.

THE DETAILS

1. The Illusion of Stability

Without an official BLS jobs report for October and November due to the government shutdown, we rely on alternate sources. Across them, the pattern is consistent:

- Revelio Labs:

- Oct: –15k jobs

- Nov: –9k jobs

- ADP:

- Nov: –32k private-sector jobs

- Chicago Fed nowcast:

- Unemployment flat at 4.4%

If you look only at these, you would conclude:

“The labor market softened slightly, but remains stable.”

But stability is the wrong interpretation. What we are witnessing is labor-market stagnation despite economic expansion—a historically abnormal configuration that signals structural change.

2. The Disappearance of Hiring

The core story of Q4 is not mass firing. It’s the collapse of hiring:

- The U.S. hiring rate has fallen to its lowest level since 2010.

- Job openings have declined across retail, manufacturing, information, and finance.

- Workers who lose jobs are taking longer to reattach to the labor market.

- Mobility is falling—people aren’t quitting because there is nowhere better to go.

In classical labor economics, recessions are defined by rising separations.

In 2025, we are seeing a recession defined by disappearing opportunities.

This is precisely how a Silent Layoff behaves:

Fewer terminations, more empty chairs.

3. The Explosion of Planned Cuts

If hiring is the quiet half of the story, planned layoffs provide the loud half:

- 1.17 million job cuts announced through November 2025—the highest since 2020.

- AI explicitly cited for ~55,000 cuts so far, including 6,000 in November alone.

- October 2025: 153,074 cuts—the largest October total in 22 years.

But the deeper point is this:

AI is responsible for far more displacement than pink slips reveal.

September Analysis estimated 300k–500k workers displaced by AI through:

- non-replacement of departing workers

- hiring freezes

- restructuring and consolidation

- automation of mid-skill tasks

- redirecting headcount budgets into AI infrastructure

October and November reinforced that estimate with new evidence from tech, telecom, finance, and logistics.

4. Output Rising, Workforce Flat

Perhaps the clearest indicator is macroeconomic:

- GDP remains strong.

- Profits remain near historic highs.

- Hours worked continue to stagnate.

- Payroll costs shrink while AI spending expands.

The economy is producing more with fewer workers and fewer hours.

This is not cyclical—it is structural.

The decoupling first visible in Q2 has now spread across Q4.

5. The Human Impact—Invisible in U-3

While unemployment remained at 4.4%, the composition changed:

- Rising long-term unemployment

- More discouraged workers

- Higher marginal attachment

- Wage stagnation for non-specialized labor

- Declining small-business employment

The official unemployment rate can remain flat even while millions lose bargaining power or exit the labor force entirely. The Q4 numbers exhibit exactly that pattern.

Thus the true cost is not captured in U-3.

It is captured in:

- declining participation,

- declining mobility,

- declining opportunity, and

- the quiet erosion of job quality and job creation.

INSIGHTS

Q4 2025 marks the moment the U.S. economy officially began to grow without growing employment.

This is not a failure of demand, nor a conventional downturn.

It is the early stage of an AI-driven reconfiguration of the labor market where:

- Workers disappear not through mass firings,

- but through process redesign, automation, and budget reallocation.

America didn’t lose 30,000 jobs in November.

It lost the need for hundreds of thousands of jobs over the past year—quietly, invisibly, and permanently.

This is the end of the “tight labor market” era and the beginning of a post-labor economy where productivity and profits detach from payrolls, and where citizens feel economic insecurity long before the statistics acknowledge it.

Political leaders will be tempted to declare the labor market “strong” because unemployment has hardly moved. They will be wrong. A society can maintain low unemployment while opportunity vanishes, wages stagnate, and workers exit the labor force in silence.

The Silent Layoff is not a single event.

It is a structural drift.

And Q4 2025 is the quarter where that drift became unmistakable.

Links and information for possible reskilling programs

Google Career Certificates

- Description: Self-paced online training in fields like IT support, data analytics, UX design, project management, cybersecurity, and AI. Includes hands-on projects, job search tools, and employer connections. Takes 3-6 months part-time.

- Eligibility & Access: Open to anyone (no experience needed); enroll online via Coursera or state partners.

- Cost: Free through scholarships or partnerships; over 1 million users in 2025.

- Stability: No cuts; expanded with ongoing $100M fund since launch, with 2025 reports showing continued growth.

- How to Start: grow.google/certificates.

Verizon Skill Forward

- Description: Free courses on digital skills, tech basics, business, AI tools, and career development via edX. Over 250 self-paced options for workforce readiness.

- Eligibility & Access: Open to the public; online signup.

- Cost: Free.

- Stability: No cuts reported; sustained through 2025 despite unrelated company changes.

- How to Start: verizon.com/learning or edX.org/verizon.

- Generation United States ProgramsDescription: Free 8-12 week bootcamps in tech (IT support, cloud), healthcare, and customer service, with mentoring and job placement. Online/hybrid formats.Eligibility & Access: Open to US residents (no degree required); apply online.Cost: Free.Stability: Nonprofit model with no cuts; expanded partnerships in 2025.How to Start: usa.generation.org.

IBM SkillsBuild

- Description: Free online platform with courses in AI, cybersecurity, cloud computing, data science, and soft skills. Includes badges, projects, and career resources; self-paced for beginners to advanced.

- Eligibility & Access: Open to anyone; sign up online for immediate access.

- Cost: Free.

- Stability: No cuts; expanded commitments from 2020-2025, including pledges for 30M people by 2030 and AI focus in 2025.

- How to Start: skillsbuild.org.

Cisco Networking Academy

- Description: Free self-paced courses in networking, cybersecurity, programming, IoT, and IT essentials. Includes simulations, certifications prep (e.g., CCNA), and career tools.

- Eligibility & Access: Open to the public; enroll online or via community partners.

- Cost: Free (some cert exams have fees, but training is no-cost).

- Stability: No budget changes or cuts reported; stable since 1997, with 2023 goal for 25M more learners by 2033 intact through 2025.

- How to Start: netacad.com.

- Per Scholas Tech TrainingDescription: Free 15-week courses in IT support, cybersecurity, software engineering, data analytics, and more. Includes job placement, coaching, and alumni support. In-person/online hybrids in 20+ cities.Eligibility & Access: Open to adults (application required, but no prior experience); targets underrepresented groups but available broadly.Cost: Free, with some stipends for living expenses in select programs.Stability: No cuts; funding increased 2020-2025 via grants (e.g., $6M in 2023, $1.5M in 2021, $1M in 2025), with expansions to new regions.How to Start: perscholas.org (apply for courses).

SkillUp Coalition Programs

- Description: Free training connections to tech, healthcare, and trade skills via partners; includes career coaching, job matching, and online courses without degrees.

- Eligibility & Access: Open to US adults; online platform for browsing and enrolling.

- Cost: Free.

- Stability: Nonprofit with no reported cuts; sustained and expanded since launch, focusing on no-degree jobs in 2025.

- How to Start: skillup.org.