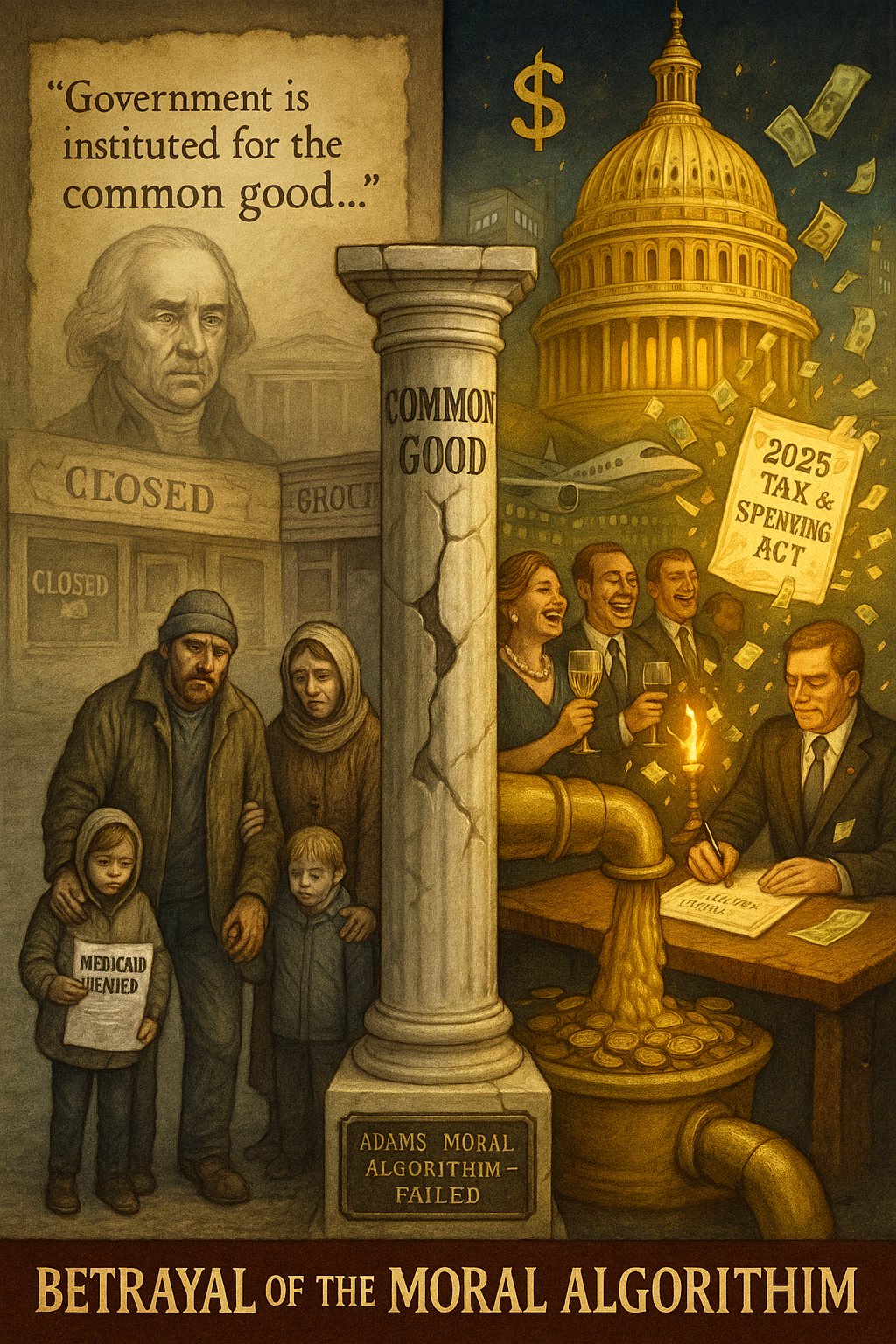

2025 Tax Bill Serves Wealthy Over Workers

Trump's 2025 tax bill cuts $930B from Medicaid, adds $2.4T to deficit while giving $4T in tax cuts to wealthy. Analysis shows 12M will lose health insurance.

John Adams, the primary architect of the Massachusetts Constitution of 1780, established a fundamental principle for American governance: "Government is instituted for the common good; for the protection, safety, prosperity and happiness of the people; and not for the profit, honor, or private interest of any one man, family, or class of men; Therefore the people alone have an incontestible, unalienable, and indefeasible right to institute government; and to reform, alter, or totally change the same, when their protection, safety, prosperity and happiness require it."

This principle, which can be considered Adams' "Moral Algorithm," serves as a litmus test for evaluating government actions. It establishes that legitimate governance must prioritize collective welfare over private gain, and it explicitly grants citizens the right to demand changes when government fails this fundamental test.

The 2025 Tax and Spending Bill: A Systematic Violation of the Common Good

Magnitude of the Policy Failure

Under the legislation Trump is expected to sign on Friday, Independence Day, reductions in federal support for Medicaid and Affordable Care Act marketplaces will cause nearly 12 million more people to be without insurance by 2034, the Congressional Budget Office estimates. President Donald Trump's big bill in Congress would unleash trillions in tax cuts and slash spending, but also spike deficits by $2.4 trillion over the decade and leave some 10.9 million more people without health insurance.

The scale of this health coverage loss represents one of the largest deliberate reductions in social protection in American history, directly contradicting Adams' principle that government should ensure the "protection, safety, prosperity and happiness of the people."

The Fundamental Contradiction: Austerity for the Poor, Abundance for the Wealthy

Devastating Cuts to Essential Services

The final vote was 51-50 with Vice President JD Vance breaking a tie. Three Republicans broke ranks and voted against the bill: Susan Collins of Maine, Thom Tillis of North Carolina and Kentucky's Rand Paul. The bill now heads to the House, where some GOP lawmakers are already signaling major objections. Tuesday's vote capped weeks of contentious negotiations between fiscal hawks who wanted deeper spending cuts, and a handful of other Republicans who expressed concerns that cuts would hurt their constituents.

The legislation makes severe cuts to programs serving society's most vulnerable:

- $930 billion in Medicaid cuts, affecting 11.8 million people's health coverage

- $285 billion reduction in food assistance programs through SNAP

- 3 million poor children losing school lunch assistance

- New work requirements that will strip coverage from millions despite most recipients already working

Massive Tax Benefits for the Wealthy

Simultaneously, the bill provides unprecedented benefits to the wealthiest Americans:

- $4 trillion in tax cuts for the wealthiest Americans over the next decade

- Permanent estate tax benefits for inherited wealth

- Bonus depreciation advantages particularly benefiting private jet manufacturers

- Enhanced deductions for state and local taxes, primarily benefiting high-income households

The top 1 percent (roughly 2.4 million people) received average tax cuts of about $61,090 by 2025 – higher than any other income group. By contrast, the middle 60 percent of earners (78 million people) saw cuts in the range of $380 to $1,800.

The Working Poor Reality: Evidence Contradicting the Justification Narrative

The Myth of Lazy Beneficiaries

The 12 million wage-earning adults (ages 19 to 64) enrolled in Medicaid—a joint federal-state program that finances health care for low-income individuals—and the 9 million wage-earning adults in households receiving food assistance from the federal Supplemental Nutrition Assistance Program (SNAP) shared a range of common labor characteristics. For example, approximately 70 percent of adult wage earners in both programs worked full-time hours (i.e., 35 hours or more) on a weekly basis and about one-half of them worked full-time hours annually.

Among adults under age 65 with Medicaid who do not receive benefits from the Social Security disability programs, Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI), and who are not also covered by Medicare, 92% were working full or part-time (64%), or not working due to caregiving responsibilities (12%), illness or disability (10%), or school attendance (7%). The remaining 8% of Medicaid adults reported that they are retired, unable to find work, or were not working for another reason.

The Reality of Low-Wage Work

Medicaid adults who work full-time are eligible for Medicaid in expansion states because they work low-wage jobs and meet income eligibility criteria. An individual working full-time (35 hours/week) for the full year (50 weeks) at the federal minimum wage ($7.25 per hour) earns an annual salary of $12,688, which is well below the Medicaid eligibility limit of 138% of the Federal Poverty Level ($15,650 for an individual; $32,150 for a family of four).

Many Medicaid adults who work are employed by small firms and are not eligible for employer-sponsored health insurance at their job. In 2023, nearly five in ten (46%) Medicaid workers were employed in firms with fewer than 50 employees, which are not subject to ACA penalties for not offering affordable health coverage and are less likely to offer health insurance to their workers than larger firms.

This evidence demolishes the narrative that safety net programs primarily serve the "undeserving" or lazy. The reality is a broken economic system where full-time workers cannot afford basic necessities without government assistance.

Economic Impact and Fiscal Hypocrisy

The Deficit Contradiction

Despite claims of fiscal responsibility, The "big, beautiful bill" backed by President Donald Trump would add $2.4 trillion to federal budget deficits over 10 years, a Congressional Budget Office analysis found. The bill passed by House Republicans last month would decrease federal spending by $1.3 trillion, but also see a $3.7 trillion drop in revenues.

According to the non-partisan Committee for a Responsible Federal Budget, interest payments on national debt will rise to $2 trillion per year by 2034 owing to the legislation, crowding out spending on other goods and services.

The bill demonstrates the opposite of fiscal responsibility: it simultaneously cuts support for the vulnerable while creating massive deficits through tax giveaways to the wealthy.

Economic Damage to Communities

Grocery store owners are also sounding the alarm, highlighting that food stamp recipients plow their benefits back into the local economy. Food stamps funding supports about 388,000 jobs and more than $20 billion in wages, and results in more than $4.5 billion in state and federal tax revenue, according to the National Grocers Association.

Hospitals and nursing homes say they use these extra Medicaid dollars to expand or add new services and improve care for all patients. Rural hospitals typically operate on thin profit margins and rely on payments from Medicaid taxes to sustain them.

The cuts will ripple through local economies, harming businesses and eliminating jobs while potentially forcing hospital closures in rural communities.

The Failure of Work Requirements: Administrative Cruelty Without Purpose

Evidence of Ineffectiveness

Work requirements have no upside. Medicaid work requirements do not increase employment, research shows, and the Congressional Budget Office concluded that the 2023 House bill would lead to coverage loss with "no change in employment or hours worked." Instead, work requirements strip health coverage from people with low incomes — most of whom are already meeting or exempt from the requirements.

In Georgia, where the work requirement applies only to people newly eligible for Medicaid, coverage gains have fallen far short of what policymakers anticipated. In the first year of Pathways to Coverage, 4,231 people had enrolled in Medicaid through the program, well below the state's first-year enrollment projection of 100,000.

The Administrative Burden Trap

Reporting work hours can be especially difficult for people with multiple jobs, people without internet or computer access, and people with limited English proficiency. Only two states have implemented Medicaid work requirements. Arkansas, the first, launched its program in June 2018 and ended it in March 2019 because of a court order. While the policy was in effect, the state required Medicaid beneficiaries ages 19 to 49 to report 80 hours of approved work or community engagement activities each month through an online portal. Failure to report hours for any three months without an exemption resulted in a loss of coverage for the remaining calendar year.

Many Medicaid enrollees work in industries in which both employment and hours are volatile. The two industries that employ the most Medicaid enrollees potentially subject to work requirements are restaurant/food services and construction. Grocery stores, department and discount stores, and the home health industry also employ large numbers of Medicaid enrollees. Jobs in these industries are characterized by: Unstable employment.

Work requirements create a bureaucratic maze designed to exclude rather than help, punishing people for the instability inherent in low-wage employment.

Systematic Violation of Adams' Moral Algorithm

Government Serving Private Interest Over Common Good

The 2025 bill represents a textbook case of government serving "the profit, honor, or private interest of any one man, family, or class of men" rather than the common good. The wealthy receive massive tax benefits while essential services for the vulnerable are slashed, creating a deliberate transfer of resources from those with the least to those with the most.

Failure to Ensure Protection, Safety, Prosperity, and Happiness

Each element of Adams' formula is violated:

- Protection: Health coverage stripped from millions, leaving them vulnerable to medical bankruptcy and delayed care

- Safety: Food assistance cuts threaten basic nutrition security for families and children

- Prosperity: Economic policies that increase inequality and reduce economic mobility

- Happiness: Policies that increase stress, insecurity, and suffering among working families

The Moral Dimension: Virtue and Governance

John Adams stated, "Our Constitution was made only for a moral and religious People. It is wholly inadequate to the government of any other." This remark captures the belief that virtues like honesty, industriousness, and piety were essential. Without these, the safeguards of liberty could not stand.

George Washington echoed this, remarking, "Virtue or morality is a necessary spring of popular government." He knew that without a populace grounded in morality, the republic would quickly spiral into tyranny or chaos.

Adams understood that democratic governance requires moral leaders who prioritize collective welfare over personal or class gain. The 2025 bill represents precisely the kind of governance Adams warned against: using public power for private benefit while abandoning the vulnerable.

The Broader Context: A System in Crisis

Historical Precedent and Warning Signs

Samuel Adams highlighted, "Neither the wisest constitution nor the wisest laws will secure the liberty and happiness of a people whose manners are universally corrupt." His assertion clarifies that the best political institutions are futile if the citizenry lacks public-spiritedness and an ethical foundation.

The current crisis goes beyond individual policies to reflect a broader erosion of the civic virtue and moral foundation that the Founders believed essential to republican government.

Economic Justice and Democratic Sustainability

The concentration of benefits among the wealthy while imposing hardship on working families creates the conditions Adams and other Founders warned could lead to the collapse of democratic institutions. When government systematically serves elite interests while abandoning its basic duty to promote the common good, it loses legitimacy and threatens social stability.

The Path Forward: Reclaiming the Common Good

Constitutional and Moral Imperatives

Adams' principle grants citizens "an incontestible, unalienable, and indefeasible right to institute government; and to reform, alter, or totally change the same, when their protection, safety, prosperity and happiness require it."

The systematic violation of Adams' Moral Algorithm in the 2025 bill creates both a constitutional and moral imperative for fundamental reform.

Policy Alternatives Aligned with Common Good Principles

A government truly committed to Adams' vision would:

- Strengthen rather than weaken social insurance programs that protect citizens from economic hardship

- Ensure that tax policy promotes shared prosperity rather than concentrated wealth

- Recognize that supporting working families strengthens rather than weakens the economy

- Prioritize investments in education, healthcare, and infrastructure that benefit all citizens

- Create economic conditions where full-time work provides a living wage without requiring government assistance

The Systemic Challenge

The fundamental problem identified in the 2025 bill—millions of full-time workers requiring government assistance while the wealthy receive tax cuts—reveals a broken economic system that contradicts both moral principles and practical governance needs. Fixing this requires acknowledging that the current model serves private interests at the expense of the common good.

Conclusion: The Test of Democratic Governance

John Adams' Moral Algorithm provides a clear standard for evaluating government action: Does it serve the common good or private interest? The 2025 Tax and Spending Bill fails this test spectacularly, representing governance that Adams would have recognized as tyrannical in its subordination of public welfare to private gain.

The bill's combination of massive tax cuts for the wealthy, devastating cuts to essential services, increased deficits, and punitive policies toward working families violates every principle Adams established for legitimate governance. It prioritizes the "profit, honor, or private interest" of a wealthy class while abandoning government's fundamental duty to ensure the "protection, safety, prosperity and happiness of the people."

This failure demands the kind of fundamental reform Adams envisioned when he granted citizens the right to "reform, alter, or totally change" government when it fails to serve its proper purpose. The stakes could not be higher: the survival of democratic governance itself depends on restoring the moral foundation Adams knew was essential to republican government.

The evidence is clear—millions of Americans work full-time yet cannot afford basic healthcare and nutrition without government assistance, while a small elite receives unprecedented tax benefits. This is precisely the kind of system Adams designed government to prevent, not enable. The 2025 bill represents not just bad policy, but a fundamental betrayal of the moral compact between government and citizens that Adams understood as the foundation of American democracy.